Identity Verification and AML compliance made easy

Overview

Verify identity and screen against global watchlists

Introducing TripleCheck

TripleCheck: the best of SmartSearch, rolled into one

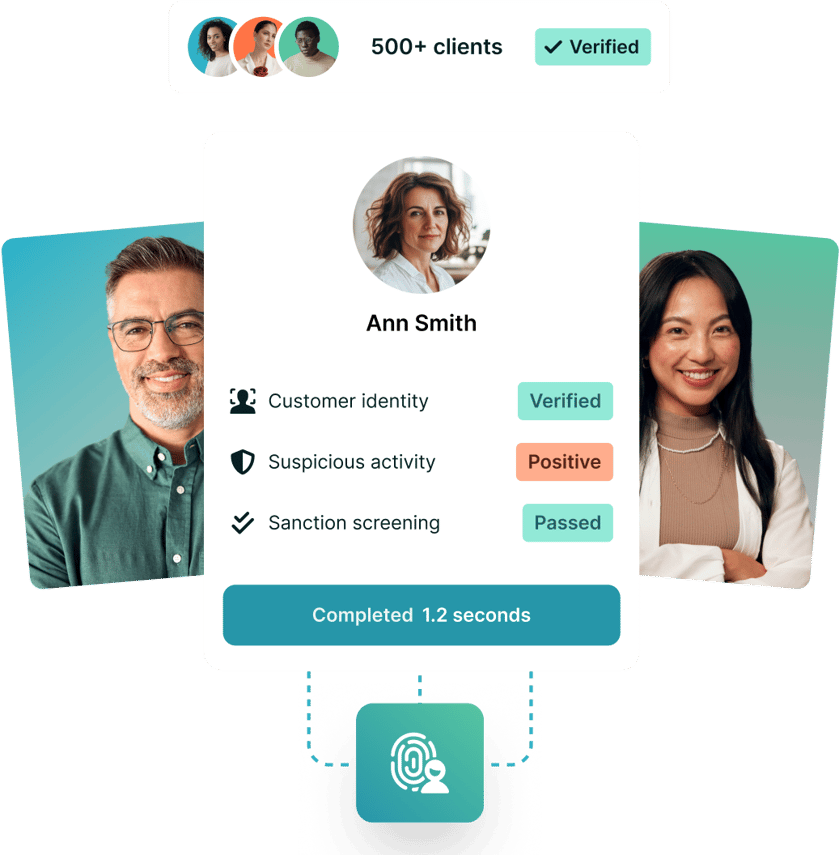

A unique all-in-one compliance solution: TripleCheck combines the best of SmartSearch into one easy process. Our award-winning customer identity & sanction checks, the most advanced facial recognition techniques, and digital fraud checks create the most comprehensive Customer Identification Program on the market.

-

1. Verify identity & screen for Sanctions

Enter your client’s details and we run identity verification, including Sanction, PEP, RCA and OFAC screening, and deliver the result in less than two seconds. -

2. Facial Recognition

Using the most advanced OCR, biometric and liveness techniques we confirm if the client and documents are genuine. -

One platform, multiple ID verification solutions

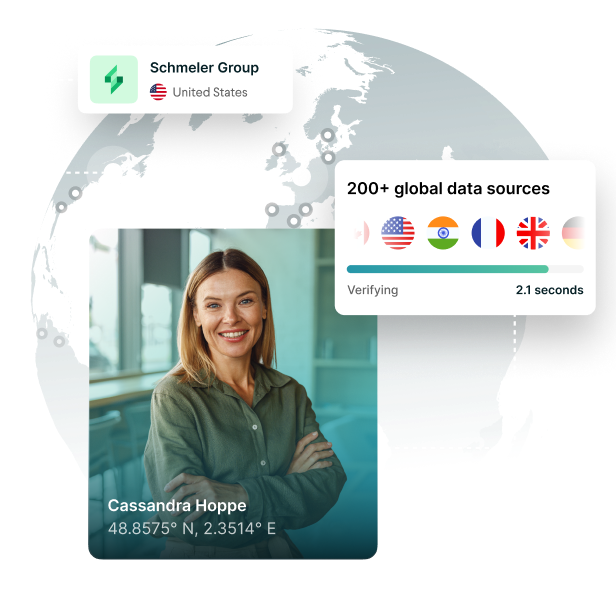

SmartSearch offers a complete Customer Identification Program for verifying US and international citizens. Our unique platform performs customer identification, full Sanction and PEP Screening, ongoing monitoring, and fraud prevention all from one place so you will never need to use multiple solutions again. It also performs institution checks to confirm the existence of the business, validate its corporate structure, and identify individual stakeholders.

-

Client identification and verification

-

Corporate and Executive checks

-

Sanction, PEP, SIP, RCA and OFAC screening

-

Automatic Enhanced Due Diligence

-

Clear results in seconds

-

Fraud prevention

-

Ongoing monitoring

-

Remote checks via the integrated app

-

Retrospective service removes compliance gaps

-

Integrate SmartSearch into your existing system

Integrate SmartSearch into your existing system

You can use the SmartSearch platform via your internet browser, the app or integrate the platform into your existing system. Integration saves time and money as it enables SmartSearch checks to be completed within your workflows, using your customer data files.

Complete identity checks anytime, from any place

Our fully integrated app enables you to complete full identity and business checks with Sanction and PEP Screening remotely from your cell phone or tablet. Just enter the customer’s details and you will receive the result to your hand-held device in seconds.

We have over 5,000 customers, from start-ups to corporate giants

HEAR THEIR STORIES

Our processes have been streamlined; we get all the information we need in one search and we no longer need to take so much time to connect the dots. We are always kept up to date with the latest developments. It is good to know they are always looking to help and simplify things for us, particularly with updates such as API integration. This is an excellent idea and would benefit many businesses to use a familiar system. We would recommend SmartSearch as an AML provider

Martina Hopgood

Client liasion

SmartSearch has now become an essential element of our onboarding process and it is great to have the ongoing monitoring working in the background too. We are kept up to date on the latest products and services which would benefit us, such as the Retro Bulk Upload for historic clients. Our account manager has offered to help with setting up any new users and we are pleased we can turn to her for help if we have any queries or require further training. We would not hesitate to recommend SmartSearch to others who would like to improve their AML processes

Nikki Conquest

Office Manager

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.