Making AML Checks and Compliance Easy

Discover effortless AML compliance with our award-winning anti-money laundering solution. Perform your due diligence and carry out Know Your Customer checks in the UK or abroad, all with our sophisticated electronic verification platform that makes AML checks easy.

Our UK Individual AML solution comes with an industry leading pass rate of up to 97%, achieved via our unique triple-bureau access, to provide a frictionless customer onboarding journey.

What we do?

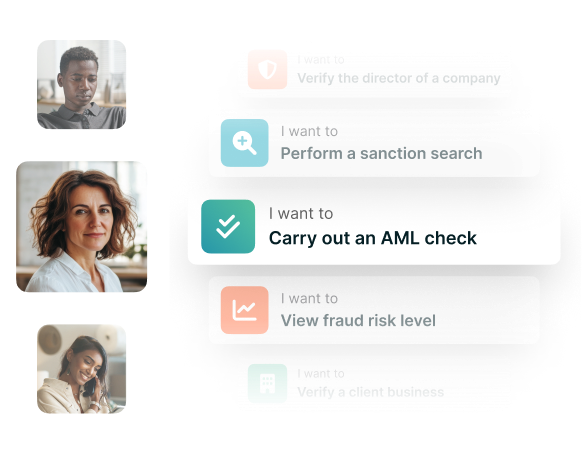

Our next-generation compliance technology, spanning KYC, KYB, Sanctions & PEPs, Document verification, Facial recognition and more, helps you to comply with regulations, fight financial crime and grow your business with confidence.

Perform UK, international and domestic AML checks all in one place.

Our efficient, automated platform performs a wide range of UK and international anti-money laundering checks using the Dow Jones WatchList, which is updated every day.

Our efficient, automated platform performs a wide range of UK and international anti-money laundering checks using the Dow Jones WatchList, ...

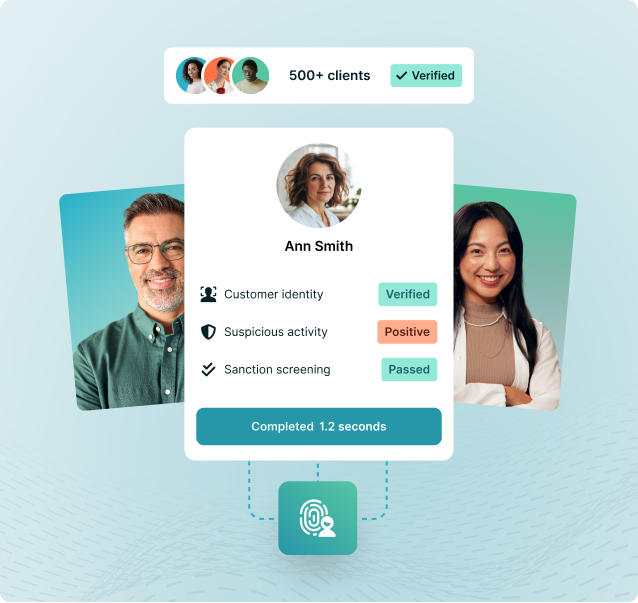

Streamline your onboarding process and benefit from industry-leading pass rates.

We have triple bureau data supply agreements with the UK's leading credit reference agencies: Equifax, Experian and TransUnion to deliver a match rate of up to 97%, clearing up 85% of your failed cases automatically.

We have triple bureau data supply agreements with the UK's leading credit reference agencies: Equifax, Experian and TransUnion to deliver a ...

Run Sanctions and PEP checks on your new and existing clients.

On our innovative platform, you can fulfil KYC requirements, conduct Sanctions checks, and check for PEPs, SIPs, and PSCs. You can also get assistance with Enhanced Due Diligence and ongoing monitoring.

On our innovative platform, you can fulfil KYC requirements, conduct Sanctions checks, and check for PEPs, SIPs, and PSCs. You can also get ...

Keep up with ever-changing AML regulations and grow your business with confidence.

SmartSearch will make sure your company keeps up with ever-changing AML regulations. Whether your prospective client is a corporation or an individual, our all-encompassing AML solution covers every base, so your business is protected.

SmartSearch will make sure your company keeps up with ever-changing AML regulations. Whether your prospective client is a corporation or an ...

.png?width=400&height=76&name=Data%20Partmers%20(2).png)

%20(1).png?width=400&height=76&name=LSEG%20(3)%20(1).png)

.png?width=400&height=76&name=bsi%20(2).png)

Serving professional AML regulated industries

Trusted by over 7,000 regulated businesses, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management.

Ensuring Solicitors and Legal firms are AML compliant

- Benefit from industry-leading pass rates

- Enhance client relationships

- Protect your reputation

- Reduce compliance risk

Innovative AML solutions for Accountants

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

AML checks for Estate Agents & Property companies

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

Delivering AML compliance for Financial Services firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

-

Experience hassle-free AML and compliance

AML technology for Investment Banking

-

Benefit from industry-leading pass rates

- Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Insurance firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

Innovative AML solutions for Gaming firms

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance for Banking organisations

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Cryptocurrency firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance technology for Property Development firms

-

Experience hassle-free AML and compliance

-

Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

-

Streamline your onboarding process

An all-in-one and easy to use AML platform

We’re more than just an automated platform. SmartSearch will assist you with the design and implementation of a risk-based approach to suit your business. We’ll keep you up to date with ever-changing anti-money laundering regulations, and be your point of contact for any queries.

/aml%20checks.png?width=855&height=855&name=aml%20checks.png)

What is included in a SmartSearch AML check?

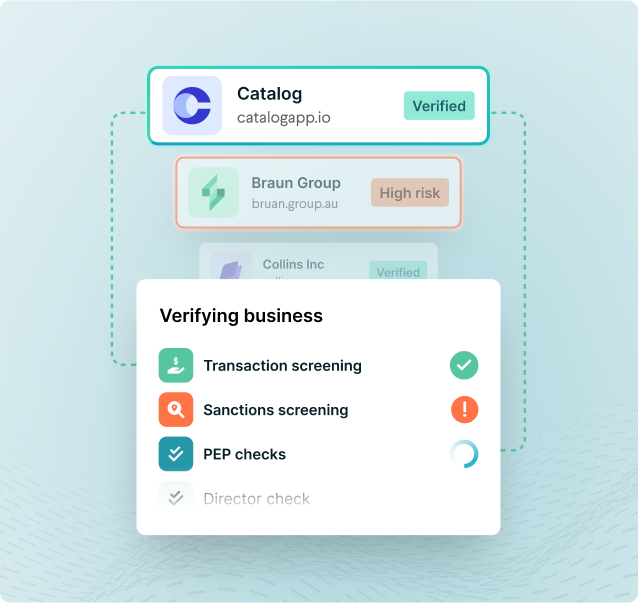

Sanctions screening

The SmartSearch platform allows you to quickly and easily complete sanctions searches on clients.

The SmartSearch platform allows you to quickly and easily complete sanctions searches on clients.

Ongoing monitoring

The ongoing monitoring functionality included in SmartSearch’s AML compliance system completes new KYC checks every night, monitors sanctions lists, PEP lists and Ultimate Beneficial Ownership (UBO) on an ongoing basis.

The ongoing monitoring functionality included in SmartSearch’s AML compliance system completes new KYC checks every night, monitors ...

Transaction screening

With transaction screening, your business can detect if and when financial crime is happening, giving you the opportunity to stop it in its tracks.

With transaction screening, your business can detect if and when financial crime is happening, giving you the opportunity to stop it in its ...

PEP checks

SmartSearch's AML software can be used to check new customer details against PEP lists, making such risks easier to identify.

SmartSearch's AML software can be used to check new customer details against PEP lists, making such risks easier to identify.

There’s a reason over 7,000 clients put their trust in us

The onboarding process has allowed us to enhance our user experience, whilst improving compliance oversight without the need for manual intervention.

Audit & Compliance Manager, Acasta Europe LimitedThe ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.

Arena Investment ManagementThe SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.

Karen Hogan, Thorntons InvestmentsThe help you need, when you need it

Whether you’re a small business just getting to grips with AML regulations or a large corporation with plenty of experience in compliance, SmartSearch can help you to comply with regulations, fight financial crime and grow your business with confidence.

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Seamless integration with the rest of your business

Integrate SmartSearch with your back office systems. Streamline workflows, reduce costs and save time with seamless automation and enhanced efficiencies. Contact us today to discuss your bespoke integration needs.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

See it in action

Whether your prospective client is a corporation or an individual, our all-encompassing AML solution covers every base, so your business is protected, allowing you to grow your business with confidence.

Let one of our highly-trained AML and compliance experts demonstrate the multi-award winning SmartSearch AML solution.

/SmartSearch_OfficeLifestyle_Feb25_115.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115.jpg)