Verify Clients Instantly with AML Technology from Smart Search

AML Property and Estate Agent Checks

Empower your property firm and grow with confidence with SmartSearch’s AML software for estate agents. Our government-certified IDSP can help onboard customers fast and securely with the latest technology. Our AML checks allow for instant verification and keep your company compliant.

Our Advanced AML Features

From customer onboarding to ongoing monitoring, SmartSearch streamlines the AML process, allowing organisations to focus on their activities without compromising on compliance.

Let’s take a closer look and see why our estate agents' AML checks are a cut above the rest:

Effortless AML Compliance for Property Professionals

At SmartSearch, we are committed to helping our clients conduct the necessary checks with a secure and efficient AML platform. AML checks for estate agents are an essential part of property checks and fighting financial fraud. Explore our services that can help make compliance easy for your property company.

-

Know your customer checks

Easily comply with regulatory guidance regarding estate agent AML checks. Negate the need for time-consuming manual checks by electronically verifying your customers.

-

Seamless customer onboarding

Complete KYC and AML checks for estate agents through one user-friendly platform. Integrate SmartSearch with your existing management system for a streamlined, cost-effective onboarding process.

-

Perform your customer due diligence

Our automated enhanced due diligence system identifies, verifies and monitors your clients on an ongoing basis - making sure you’re always compliant.

-

PEP Screening

Part of the more enhanced due diligence process, this screening process identifies politically exposed persons or PEPS who are at a greater risk of fraud or being involved in financial crime.

-

Fraud prevention

Mitigate the risk of fraudulent transactions through our comprehensive fraud prevention solution, which can be tailored to create a bespoke package for your needs.

-

Suspicious Activity Reports (SARs)

With advanced automation capabilities, you can make use of our platform’s high-tech tools that make submitting SARs simple. Streamline your compliance and enhance your operational efficiency.

Integrate SmartSearch’s capabilities into your own system

We can integrate our services with your existing software, so you can run AML checks using information from your own system.

AML regulations are consistently updating to reflect the changing tactics of those who perpetrate financial crime – keeping on top of regulatory requirements can be both tricky and time-consuming.

Our SmartSearch system evolves right alongside regulations from the FATF and the FCA. We adapt our technology and product offerings to ensure there are never any gaps in compliance for estate agents and property firms, helping you to stay effortlessly compliant.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

How Do SmartSearch AML Checks Work For Estate Agents?

Our platform uses biometric analysis, continuous monitoring and data-driven verification to make the AML process smoother and faster. When conducting checks, the need for physical documents and in-person verification is also removed.

Reduced admin time with electronic verification

Verify an individual in seconds using facial recognition. Our platform performs cutting-edge AML checks for estate agents.

Verify an individual in seconds using facial recognition. Our platform performs cutting-edge AML checks for estate agents.

Client Onboarding

The onboarding process is rapidly increased, with our system instantly verifying identities and customer transactions from a range of sources.

The onboarding process is rapidly increased, with our system instantly verifying identities and customer transactions from a range of ...

Enhanced Due Diligence

If suspicious activity or risks are flagged, our system automatically initiates EDD checks, which include PEP screening and sanction reviews. This extra step helps meet compliance requirements and also stops threats from passing through the system.

If suspicious activity or risks are flagged, our system automatically initiates EDD checks, which include PEP screening and sanction ...

Ongoing Monitoring

We also provide continuous ongoing monitoring of your verified customers, where their transaction data and user behaviour is recorded and analysed for any threats. If a customer’s risk status changes, you’ll receive an instant alert so you can act fast and prevent any crime.

We also provide continuous ongoing monitoring of your verified customers, where their transaction data and user behaviour is recorded and ...

We are trusted by over 1,000 property firms

“Poole Townsend are long standing clients of SmartSearch, having been using the SmartSearch platform for 9 years now. The team find the system incredibly easy to navigate and understand and we rarely get any queries from the users who run searches. We are very happy with SmartSearch and would recommend the platform to other companies who are wanting to streamline their internal AML compliance processes.”

Rochelle Edwards

Poole Townsend

5 key AML property sector obligations – which ones are you on top of?

Every estate agency business in the UK is legally required to be registered with HMRC for money laundering supervision. Estate agencies that fail to register can be hit with fines.

According to a January 2022 report, a quarter of estate agents in the UK had not yet registered with HMRC for the purposes of complying with AML rules, some four years after the law required them to comply. This meant that thousands of estate agents were committing a criminal offence by failing to register themselves with the department.

Such contravention of the law could lead to significant fines for your property business, depending on the number of branches your organisation has. These fines are typically around £5,000 to £6,000 even for smaller estate agents that fail to register for AML purposes.

Registration with HMRC should be the responsibility of the Money Laundering Reporting Officer (MRLO), the nominated individual in your company who’s put in charge of implementing AML policies. AML checks for estate agents will be controlled by this individual, who will be expected to monitor customers and report suspicious activity as and when is appropriate.

MLROs will also be responsible for conducting AML risk assessments in which they identify and evaluate possible suspicious activity to mitigate the risk of money laundering. This risk assessment process can be easily streamlined with the help of SmartSearch. By using our service, we can tailor an AML risk assessment package to the needs of your industry, making your compliance effortless.

Another key part of estate agents’ AML obligations is ensuring that a prospective property buyer has obtained the money for their purchase from a legitimate source.

So, for every property transaction you handle, you will need to obtain evidence of where the buyer’s funds have come from, otherwise known as a ‘Source of Funds’ check. If, for example, the buyer claims they have earned the money from regular income as an employee, you should be able to verify this against bank statements.

For any property transaction, there is a need to seek proof that the person selling the property is the genuine owner. You can check this by looking at the property’s title deeds via the Land Registry. The title deeds will show the names of the current owners, which estate agencies are required to cross-reference against the seller’s IDs and a recent utility bill.

There has been a legal requirement since 1990 for all residential properties in England and Wales to be registered on the Land Registry Portal. So, it is likely that any given property is registered already.

In the event that a particular property your client is looking to sell is not registered, the owner will need to find the property’s original deeds, which might still be with their mortgage provider or solicitors who handled their property transaction previously.

If the property owners are still unable to find the deeds, they will need to apply to the Land Registry for a Title Absolute. This can be a time-consuming process, so estate agencies should be proactive in determining at an early stage whether this will be needed for a given property transaction. That, in turn, will enable the owners of the property to apply as soon as possible.

After collecting these documents, you are required to record and keep them on file for five years.

When performing your due diligence by fulfilling AML checks for estate agents, you are required to take the appropriate steps to verify the identity of your clients. You can do this by – among other measures – requesting and obtaining a form of official ID, such as a passport or driving licence, to prove the individual’s name. A recent utility bill, meanwhile, will show the client’s postal address.

After collecting these documents, you are required to record and keep them on file for five years.

Once your estate agency business has verified the client’s identity, you will need to assess the risk, if any, of entering into a business relationship with them.

This will necessitate screening the individual’s details against sanctions and global watchlists, in addition to carrying out PEP (Politically Exposed Person), SIP (Special Interest Person), RCA (Relatives and Close Associates) and adverse media screening on them.

As critical as these checks are for the purposes of AML & compliance, they can also be onerous and time-consuming for many estate agencies. So, don’t hesitate to choose SmartSearch to streamline all of these tasks into a single, easy-to-use platform.

Detecting suspicious activity and mitigating risks in the property market

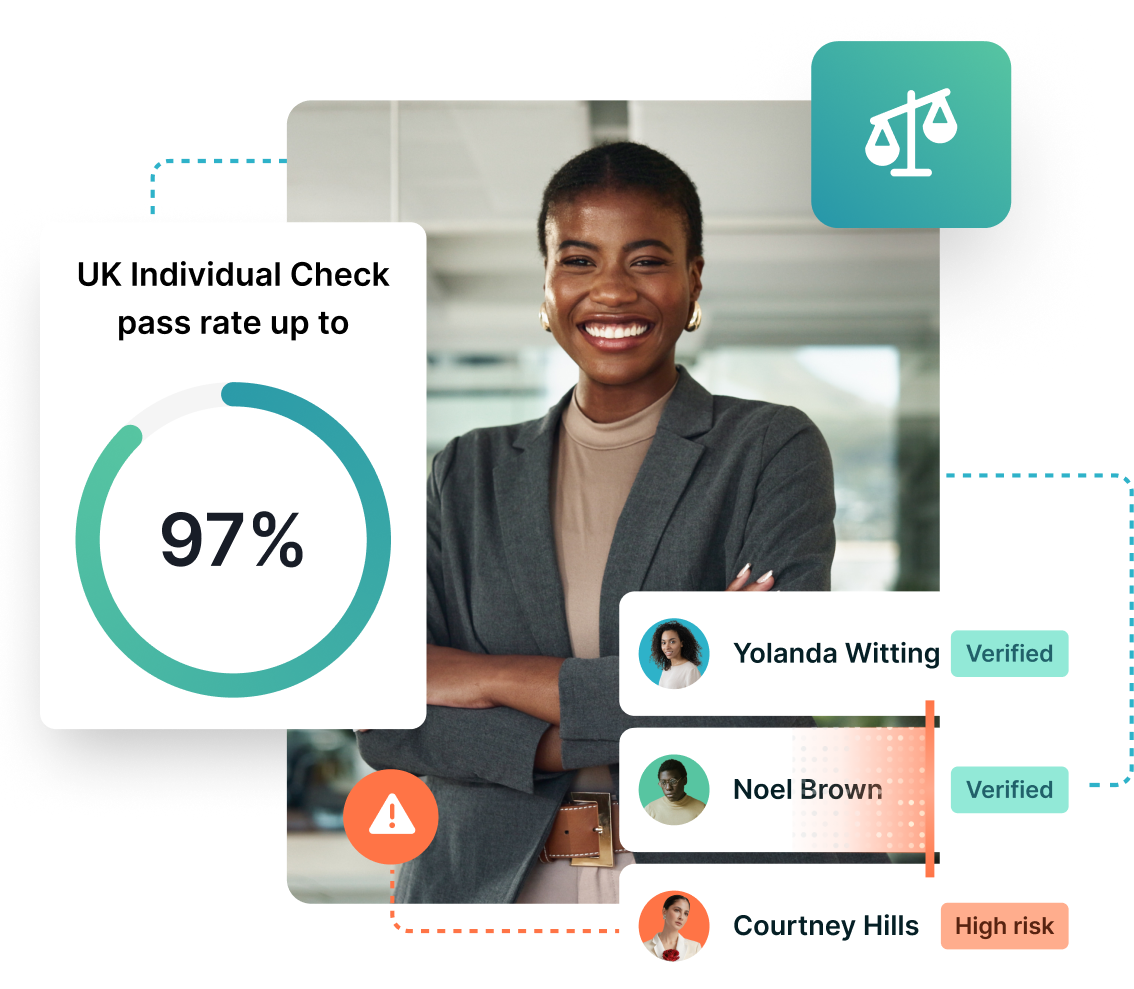

SmartSearch offers access to one of the most extensive and up-to-date databases, ensuring comprehensive coverage for digital compliance. This vast multi-bureau dataset enables us to deliver accurate results, minimising the risk of false positives and ensuring regulatory compliance with minimal dropouts.

Customer risk

High-ranking foreign officials or PEPs will require particular scrutiny due to the international provisions.

High-ranking foreign officials or PEPs will require particular scrutiny due to the international provisions.

Geographical risk

If the geographical difference between the property and the prospective buyer seems inexplicably wide, this will need to be accounted for.

If the geographical difference between the property and the prospective buyer seems inexplicably wide, this will need to be accounted for.

Transaction risk

Estate agents must take a risk-based approach to help identify causes for concern to reduce the likelihood of suspicious wealth being used.

Estate agents must take a risk-based approach to help identify causes for concern to reduce the likelihood of suspicious wealth being used.

Keep Your Estate Agents Compliant with Our AML Software

The world of AML and financial compliance is constantly evolving, but with our advanced SmartSearch software, you can stay on top of any changes. Our software evolves to stay updated with new regulations and methods of defending your estate agents against financial crime.

Discover we can make the AML process easy for your property firm whilst staying compliant.

How our resources can support you

-

Case Studies

Read case studies of how businesses have streamlined their operations with SmartSearch.

-

Blogs

Explore our latest blog posts for breakdowns of industry trends, expert tips and more.

-

Frequently Asked Questions

Estate agents and property firms should ask for proof of identity early on in the proceedings, whether the client is selling or buying a house. They are legally obliged to confirm the identity of clients is legitimate, as part of their KYC checks for AML compliance. This is in line with legal requirements from the FATF, and guidelines from the FCA.

Following guidance from the Property Ombudsman, Estate agents are legally obliged to ask for proof of funds, which includes confirming the monetary amount and checking that these funds have a legitimate source. This allows estate agents to confirm that the funds are not the proceeds of illicit financial activity, like money laundering.

There are various rules and regulations governing AML for estate agents in the UK, including the need to register with HMRC for money laundering supervision.

As an estate agent, you are also expected to carry out a range of AML checks for each property transaction that you handle. These include obtaining proof that the person selling a given property is the genuine owner, as well as seeking proof of your clients’ identities, and ensuring the prospective buyer’s funds have been obtained through legitimate means. You will also need to carry out PEP (Politically Exposed Person) and sanctions screening.

AML & compliance should be among your estate agency business’s utmost priorities in its dealings with HMRC. The department sets out various rules and guidelines in relation to AML for estate agents.

- Steps that your estate agency business should take to ensure the satisfaction of HMRC include, but are not necessarily restricted to:

- Ensuring that you have a policy, controls, and procedures document in place

- Appointing an MRLO, a nominated officer who will be responsible for handling all money laundering suspicions. Larger property businesses will also need to put in place a Deputy Nominated Officer

- If your business has more than one branch, appointing a Compliance Officer is essential to make sure the business takes the appropriate steps to achieve compliance

- Training staff on the risks in relation to money laundering and terrorist financing

- Identifying the existence of all property owners and any other beneficial owners in a given property transaction

- Assessing the risk of money laundering involvement for all sellers, beneficial owners, and buyers

- Ensuring that customer due diligence is completed on all customers and beneficial owners before your estate agency enters into a business relationship with them

- Carrying out enhanced due diligence on individuals who are categorised as higher risk.

Failing to comply with the department’s AML regulations could result in civil penalties or even prosecution. Such punishments could include unlimited fines and prison sentences of up to two years. Estate agencies that do not comply with the regulations may be at risk of money laundering charges under the Proceeds of Crime Act 2002.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.