The benefits of automating document verification | SmartSearch

In the financial industry, it\u2019s more important than ever to create effective AML procedures to protect your business against fraud and comply with...

Explore our award-winning document verification services and see how our software can simplify AML (anti-money laundering) checks, and ensure compliance is always met - regardless of the industry you work in.

Find out more and speak to a member of our expert team today.

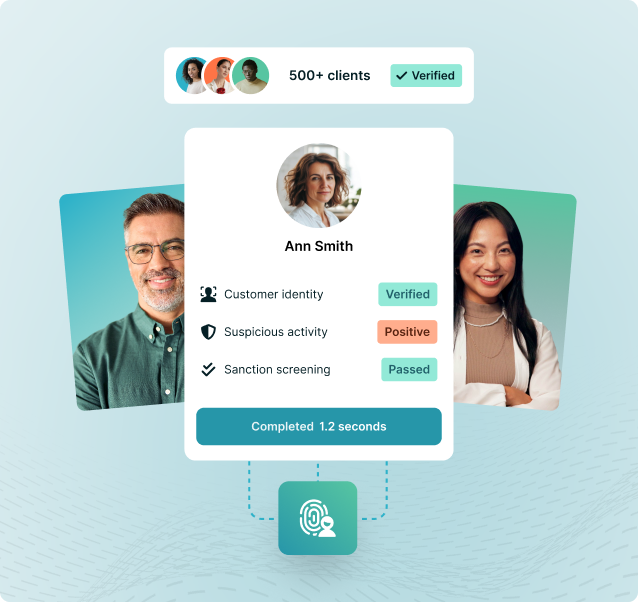

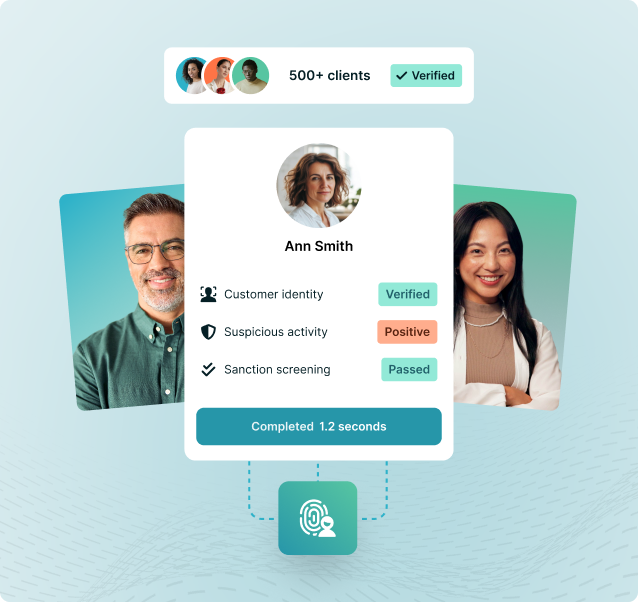

Our digital document verification services are easy to implement in your business. The user-friendly system generates easy-to-interpret results and reports, and our intelligent TripleCheck software creates reports and verifies identities in seconds.

Compliance with the AML regulations is imperative for financial firms, and document checks can keep your company safe from penalties while preventing fraud.

Our document verification solution helps your company stay compliant during KYC checks and reduces the risk of manual errors and missed red flags.

Our document verification solution helps your company stay compliant during KYC checks and reduces the risk of manual errors and missed red ...

Speed up the onboarding process and keep customers happy with fast and effective SmartDoc technology that verifies identities and document authenticity.

Speed up the onboarding process and keep customers happy with fast and effective SmartDoc technology that verifies identities and document ...

Document verification allows companies to accurately and quickly identify risks to create risk assessments that can be used to effectively allocate resources.

Document verification allows companies to accurately and quickly identify risks to create risk assessments that can be used to effectively ...

Verify documents during onboarding and ongoing monitoring to assess customers and sanction screening statuses as they change in real time.

Verify documents during onboarding and ongoing monitoring to assess customers and sanction screening statuses as they change in real time.

Our online document verification checks include a variety of different examinations, using both original documents and certified copies to check identity proof in a short space of time. There are several forms that our identity verification services can take:

At SmartSearch, we can combine our document verification solution with our other digital services, including our award-winning AML offerings. Your package can be tailor-made for you and your organisation, streamlining your business operations so your team has more time to focus on other matters.

Using SmartSearch for your document verification checks gives your business a faster, more secure way to meet your compliance requirements. With our automated checks, you can:

At SmartSearch, we have three key document verification options available to our clients, with each one being suitable for different business needs and operations:

The first option we offer is basic document verification, involving an OCR algorithmic check on the ID document’s MRZ (Machine Readable Zone). This system verifies whether the document you’ve been given is genuine and unaltered, whilst also screening for PEP and Sanction matches.

Our second option is basic document verification with facial recognition, further enhancing your digital identity procedures. Combining leading document authentication technology with the latest biometric verification and liveness detection techniques provides a true picture of your customer.

Our third option is enhanced document verification, providing an additional level of security for your business. This check requests manual scrutiny by an ID Document expert, who will then examine every aspect of the document.

If you’re looking for a personalised package for your company, contact us and we’ll be happy to help

We’re more than just an automated platform. At SmartSearch, we will assist you with the design and implementation of a risk-based approach to suit your business. We’ll always keep you up to date with ever-changing anti-money laundering regulations and be your point of contact for any queries.

Please read on to find out more about how our clients rate our services:

‘The onboarding process has allowed us to enhance our user experience while improving compliance oversight without the need for manual intervention.’

Audit & Compliance Manager, Acasta Europe Limited‘The ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.’

Arena Investment Management‘The SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.’

Karen Hogan, Thorntons InvestmentsFor more information about how we’ve helped our clients in the past, please see our dedicated Case Studies page.

Trusted by over 7,000 regulated businesses around the globe, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management. We work with a variety of different organisations from across the industrial spectrum, able to tailor our online document verification to your every need.

Here are some of the key industries we work with:

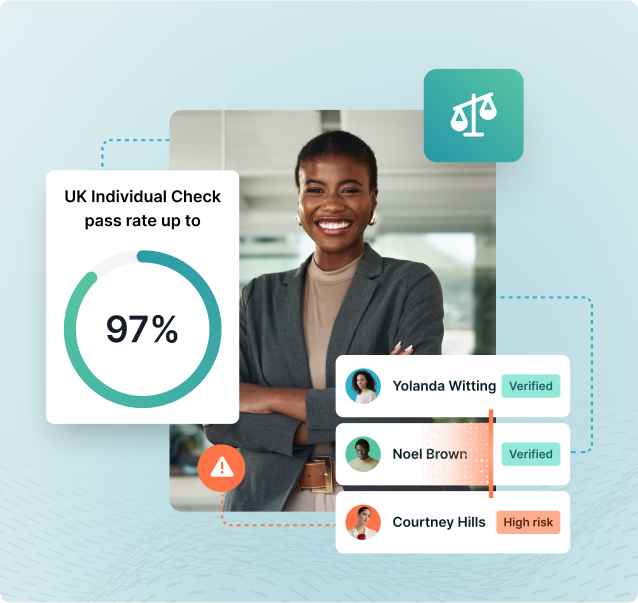

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Experience hassle-free AML and compliance

Benefit from industry-leading pass rates

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Experience hassle-free AML and compliance

Benefit from industry-leading pass rates

Streamline your onboarding process

Our global ID checks are available in over 200 countries, ensuring that every document is processed under the same rigorous checks as our UK-based clients. This means you don’t need to worry about complex regulatory, cultural and technological differences in other countries, as we can integrate numerous data sources to mitigate these issues.

Our platform supports up to fourteen different government-issued document types, including:

Document verification (sometimes known as identity verification) is the process of confirming the authenticity of a document and also the identity of the individual or the ownership.

Our document verification services are an essential part of the anti-money laundering process, using our powerful technology to confirm the authenticity of a range of documents, including ID and utility bills. Advanced technology such as AI (artificial intelligence) and facial recognition biometrics can also be utilised to detect fraudulent documents, ensure regulatory compliance and streamline your business processes.

At SmartSearch, we can also offer full training for your team, ensuring they understand how to implement our document checks successfully. We offer flexible, tailored training, able to effortlessly incorporate our advanced systems into your organisation in no time.

Find out more about our events and webinars here.

If you’d like to keep up to date with the latest AML regulation changes, you can view our insightful blog. Our blog provides you with a series of helpful guides that will make incorporating our platform into your company as simple as possible.

If you’re ready to chat with our team about using our digital document verification services, we’ll be happy to help. Please contact our team here or book your free demo to see how everything works.

/SmartSearch_OfficeLifestyle_Feb25_115%201.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115%201.jpg)

If you still have questions after reading through this page, please explore our FAQS below or feel free to contact us to find out more about our document checks.

Document verification checks help to prevent fraud, improve regulatory compliance and streamline onboarding and identity verification processes, having several major purposes that can benefit your brand.

Many industries and fields use document verification services, but the most common are the banking, real estate, healthcare and e-commerce sectors.

Just about any document or form of ID can be verified using our document checks, but the most common are things like passports, bank statements, utility bills and driving licenses.

In the financial industry, it\u2019s more important than ever to create effective AML procedures to protect your business against fraud and comply with...

The Rising Challenge of Financial Crime in a Digital World In our rapidly digitalising world, financial crime is becoming more sophisticated. This...

/SmartSearch_OfficeLifestyle_Feb25_086.jpg?width=464&height=275&name=SmartSearch_OfficeLifestyle_Feb25_086.jpg)

At the Old Bailey on 30 September, two former Royal Bank of Scotland executives appeared in court, accused of pulling off a \u00A34m mortgage fraud.

Want to discover the benefits that our award-winning document verification checks can bring to your business? Get in touch for…