AML Solutions For Banks and Building Societies

Banks and Building Societies

The SmartSearch Difference

Solutions for Banks and Building Societies

-

Know your customer

You can identify and verify individuals and businesses in a matter of seconds, giving you peace of mind that your customers are who they say they are.

-

Easier customer onboarding

SmartSearch's all-in-one system enables you to meet all your compliance requirements from one place - you can even automate your client onboarding processes via MVT technology for smoother and quicker customer onboarding.

-

/SmartSearch_OfficeLifestyle_Feb25_019.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_019.jpg)

Perform enhanced due diligence

Our systems screen all checks for PEPs and sanctions, automatically completing enhanced due diligence on any matches to ensure you are meeting your KYC requirements.

-

Ongoing monitoring

To ensure continued compliance, our ongoing monitoring service checks every customer daily and alerts you to any changes to their PEP or sanctions status to ensure you remain compliant.

-

Prevent fraud

We offer a comprehensive range of anti-fraud services - including validation of IDs, bank accounts, mobiles and other devices and IP addresses as well as global fraud data monitoring to protect your fraudsters.

-

Automatic audit trial

Our system automatically records all search results, giving you a full compliance record and ensuring your firm is always audit-ready. We can even batch upload and retrospectively check existing customer databases to close any compliance gaps.

Integrate SmartSearch’s capabilities into your own system

From identification and verification, to screening, monitoring and record keeping, we offer the most reliable and robust AML, compliance and fraud prevention solutions on the market and each product in our suite of solutions can be tailored to your firm’s individual compliance needs.

Our cloud-based software can be integrated into your existing systems, making customer onboarding simple and removing the risk of error through re-keying of customer data.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

Protect Your firm With SmartSearch

Identify customers in seconds

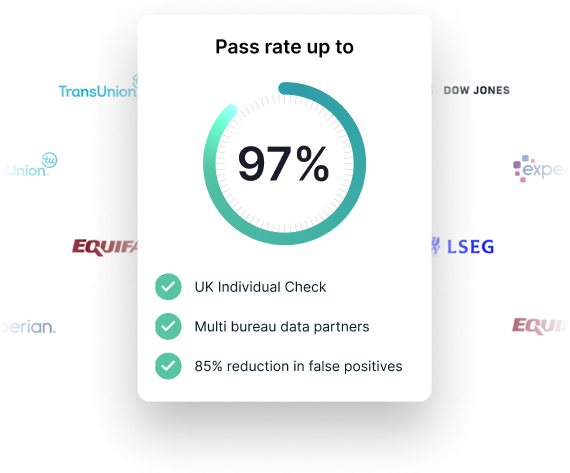

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Enhance client relationships

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Protect your reputation

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a company's reputation.

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a ...

Reduce compliance risk

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Our technology is used by 32% of Building Societies in the UK

SmartSearch has been a real blessing to Kingdom Bank over the past few years. Their use of AML checking and incorporating of PEPs and Sanctions screening is great and has assisted the Bank with any ongoing or enhanced due diligence that has been required.

Sam Hind

Compliance Officer

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Frequently Asked Questions

There are three stages in the money laundering process, but it is most easy for Banks and Building Societies detect during the first stage, which is placement. During the placement stage, cash is broken up into smaller amounts, and moved around in an attempt to put distance between the money and its illegal origins. Some launderers may make deposits in shell bank accounts at this point – and these can be easy for financial institutions to spot, if they appear in a large lump sum or a suspicious number of smaller deposits. Shell bank accounts are also used in the second stage of money laundering – layering – where the money is passed through multiple transactions and movements to “wash” it, but this is often harder to detect.

Banks and Building Societies in the UK can prevent money laundering by following the AML regulations from the FATF, and meeting the guidelines from the FCA. That means implementing a risk-based approach, with an extensive screening process including KYC, PEP and sanctions checks, as well as ongoing monitoring and Enhanced Due Diligence on any matches. KYC checks specifically can be used to prevent the creation of shell accounts by those who have a history of financial crime, as they enable you to verify the identity and reputation of your clients and customers, before you enter into business with them.

The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 (POCA 2002), the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLR 2017), the Terrorism Act 2000 (TA 2000), the Crime and Security Act 2001 (ATCSA 2001) and the Terrorism Act 2006 (TA 2006).

Using EV is by far the most reliable way to carry out know your customer and know your business checks on new and existing clients. As criminals produce ever-more sophisticated fraudulent versions of documents like passports and driving licences, EV can also verify official documentation quickly and reliably.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.