AML Software for Accountants

The SmartSearch Difference

Solutions for Accountants

-

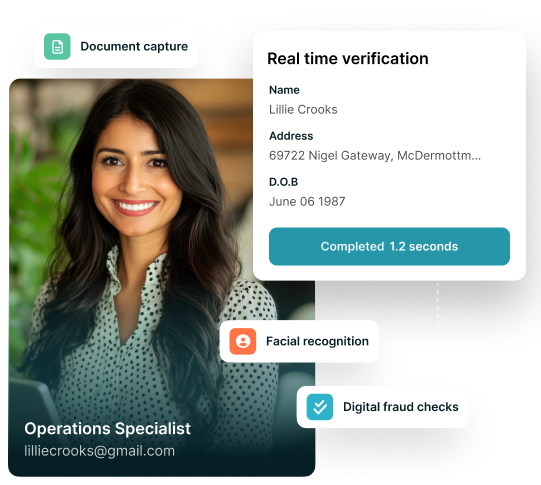

KYC checks for accountants

Electronically verify your customers and meet your due diligence obligations with the help of our automated facility for PEP and Sanction warning alerts.

-

A centralised solution

Our platform completes AML and KYC check all in one place - and can even integrate with your existing system - streamlining your AML procedures and enabling you to verify your entire client base through one user-friendly interface.

-

Conduct your due diligence

Through our due diligence dashboard we ensure identification, verification and ongoing monitoring are completed on all your customers ensuring you can remain fully AML compliant at all times.

-

Manage monitoring

Our daily monitoring service takes updates from the world's most accurate and up-to-date PEP and Sanctions list in the world so we can alert you if any of your client's statuses change.

-

Mitigate the risk of fraud

We offer a wide range of comprehensive anti-fraud services that can be tailored to create a bespoke fraud prevention solution for your business.

-

Evidence your compliance

With the SmartSearch solution, you are always audit-ready. We can even retrospectively batch-upload existing customer bases to ensure a clean, compliant position.

Integrate SmartSearch’s capabilities into your own system

SmartSearch can help you with every step of your AML compliance, right through from initial checks to ongoing monitoring – but we can also adapt our products to suit you.

Whether you’re a part of a large accountancy firm or an individual practitioner, we’re able to integrate our services with your existing software, so you can run AML checks using information from your own system.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

Empowering Accountancy Firms with Secure Identities

Identify customers in seconds

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Enhance client relationships

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Protect your reputation

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a company's reputation.

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a ...

Reduce compliance risk

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Our services are used by 1 in 2 of the top 100 accountancy firms

The platform is easy to use and very user friendly – we’re able to verify client’s identities within a few clicks, making the process of onboarding clients straightforward. The search results are also concise and easy to understand.

Meyrick Field

Governance Compliance and Quality Lead

Our compliance department especially benefits from the wide range of information SmartSearch incorporate into their platform, giving us a clear result once the check is complete

J A Black

Partner

After an extensive review of multiple providers, we decided on SmartSearch for our AML procedures as it was the best platform we had seen and offered everything we need to ensure we are fully compliant.

Charter Tax

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Frequently Asked Questions

According to the Serious Fraud Office, there are three key tell-tale signs which accountants should look out for when trying to prevent money laundering. These are as follows:1. If a long-term client or customer behaves oddly, or makes uncharacteristic requests. 2. A client or customer asks you to make financial arrangements which don’t make sense commercially. 3. A client or customer asks you to provide services which are outside your area of expertise, and does so on multiple occasions.

There are some fifteen different supervisory bodies responsible for monitoring the AML compliance of accountants, bookkeepers and other financial advisers, but these bodies are in turn overseen by the OPBAS. These regulatory bodies include the Association of Accounting Technicians, the Association of Chartered Certified Accountants, the Financial Conduct Authority and the Institute of Financial Accountants. To see a full breakdown of the supervisory bodies for this sector, visit GOV.UK.

Yes, sole practitioners still need to ensure that they are AML compliant. The Money Laundering Regulations 2007 stated that any company OR individual that is providing accountancy services must be registered with an appropriate supervisory body, so their AML compliance can be monitored.

Serious consequences, such as hefty fines, criminal prosecutions, and reputational harm, can arise from failing to meet AML requirements. Partners and staff members of the company can occasionally be held personally accountable and a fraud or failure to comply can significantly damage the reputation of a company.

Electronic verification is widely recognised by regulators, product providers and professional bodies as probably the most reliable, secure and efficient source of information for identity solutions. Regulators need to remain impartial so don’t recognise any particular supplier.

Using EV is by far the most reliable way to carry out know your customer and know your business checks on new and existing clients. As criminals produce ever-more sophisticated fraudulent versions of documents like passports and driving licences, EV can also verify official documentation quickly and reliably.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.