Anti-Money Laundering Checks for Investment Firms

Investment

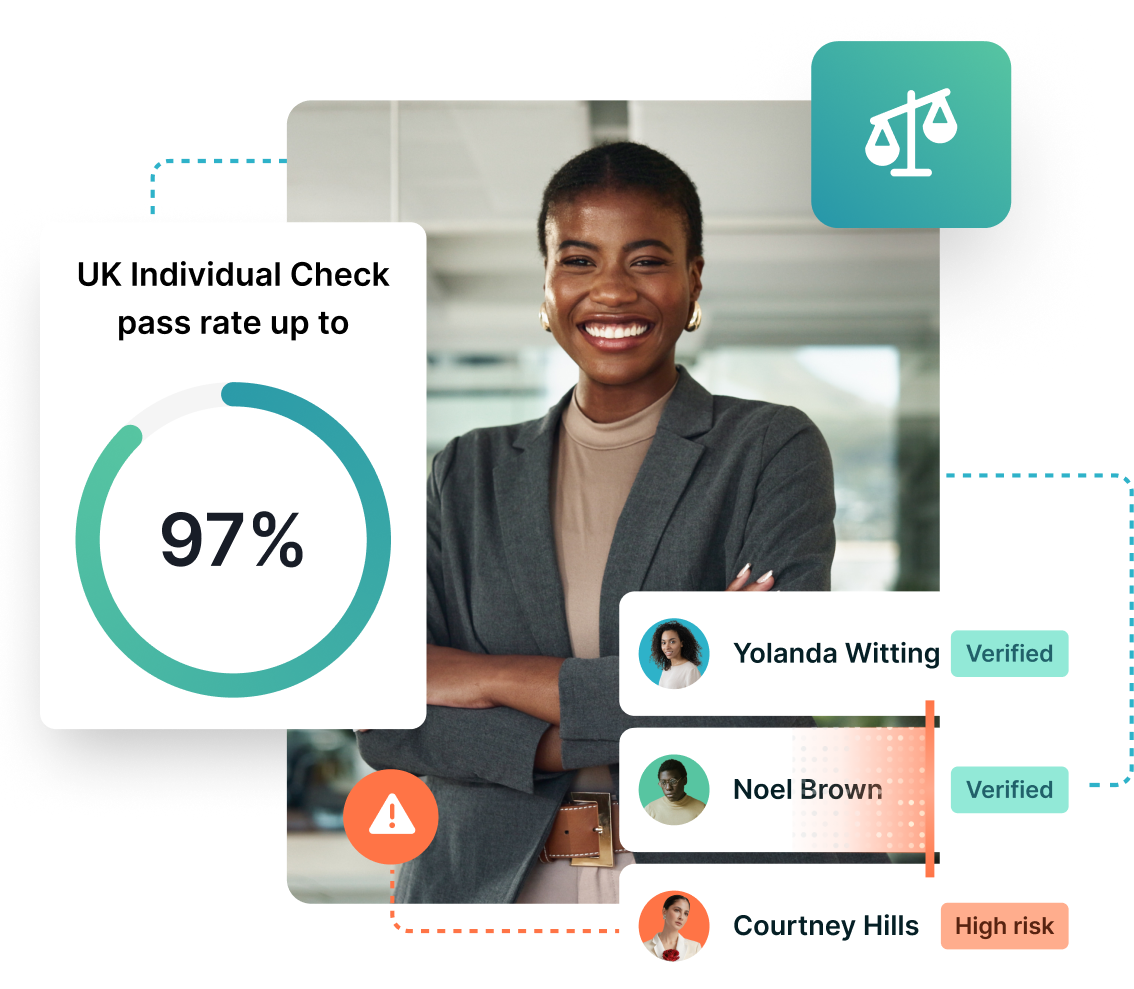

We leverage cutting-edge technology to create trusted solutions that meet the ever-evolving needs of our customers. Our commitment to innovation empowers us to stay ahead in the market while maintain the trust of our clients. We provide tailored AML, KYC, compliance and anti-fraud services for investment firms, with an industry leading pass rate of up to 97%.

The SmartSearch Difference

Solutions for Investment Firms

Driving innovation with trusted solutions for Investment Firms

-

Identifying your customers

Remain compliant in the simplest and most cost-effective way with electronic verification and automated enhanced due diligence.

-

Customer onboarding

Integrate with your current system or simply use our platform through a web browser to complete all your AML and KYC checks in one place.

-

Do your due diligence

Continuously monitor your active client base for PEP and Sanction status changes with our unique automated enhanced due diligence facility which ensures you always remain compliant while saving you time and money.

-

Monitor your clients

Powered by Dow Jones, our ongoing monitoring feature reviews PEP and Sanction watchlists globally, alerting you to any status changes and keeping you compliant at all times.

-

Prevent fraud in your investment bank

Our range of anti-fraud products have been designed to provide comprehensive solutions for customers across all industries and can be tailored to your specific requirements.

-

Be audit ready

By using our batch upload feature, ongoing monitoring and automated audit notes you can ensure your processes are watertight and that you are always audit-ready.

Integrate SmartSearch’s capabilities into your own system

SmartSearch can help you with every step of your AML compliance, right through from initial checks to ongoing monitoring – but we can also adapt our products to suit your firm.

Whatever the size of your investment firm, we’re able to integrate our services with your existing software, so you can run AML checks using information from your own system.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

Protect Your Investment Firm With SmartSearch

Identify customers in seconds

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Enhance client relationships

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Protect your reputation

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a company's reputation.

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a ...

Reduce compliance risk

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

There's a reason over 7,000 clients put their trust in us

SmartSearch provided a solution that took away the administrative and timely burden of requiring potential clients to provide documentary evidence. Not only did it provide easy identity verification for individuals, but also a thorough breakdown of all necessary evidence for identifying companies, such as annual reports, certificate of incorporation and the AML of all influential stakeholders and directors. This far outshone the level of service we had previously received from the competitor.

Jonathan Howland

Compliance Officer

We would not hesitate to recommend SmartSearch to anybody who wants to improve and enhance their AML compliance procedures.

Karen Hogan

Compliance and Risk Administrator

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Frequently Asked Questions

Using EV is by far the most reliable way to carry out know your customer and know your business checks on new and existing clients. As criminals produce ever-more sophisticated fraudulent versions of documents like passports and driving licences, EV can also verify official documentation quickly and reliably.

Electronic verification is widely recognised by regulators, product providers and professional bodies as probably the most reliable, secure and efficient source of information for identity solutions. Regulators need to remain impartial so don’t recognise any particular supplier.

The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 (POCA 2002), the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLR 2017), the Terrorism Act 2000 (TA 2000), the Crime and Security Act 2001 (ATCSA 2001) and the Terrorism Act 2006 (TA 2006).

Serious consequences, such as hefty fines, criminal prosecutions, and reputational harm, can arise from failing to meet AML requirements. Partners and staff members of the company can occasionally be held personally accountable and a fraud or failure to comply can significantly damage the reputation of a company.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.