Verify Customers Instantly with our advanced KYC Software

Know Your Customer

The core features of our Know Your Customer process

The quality of your KYC processes all depends on the tools you have at your disposal, and our advanced system allows for comprehensive customer identification that ensures you’re fully compliant with AML regulations.

Our all-in-one AML and KYC software : TripleCheck

Create a comprehensive KYC System with SmartSearch

Our KYC services can help simplify compliance for your organisation, drastically reduce onboarding times and protect your reputation and finances against fraud. Request a free demo today and see how we can transform your AML processes.

The help you need, when you need it

Whether you’re a small business just getting to grips with AML regulations or a large corporation with plenty of experience in compliance, SmartSearch can help you to comply with regulations, fight financial crime and grow your business with confidence.

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

What are Know Your Customer processes?

Know Your Customer (KYC) processes are regulatory procedures that financial institutions need to carry out in order to identify clients before onboarding. KYC checks are designed to prevent fraud, money laundering and other financial crimes by verifying the identities of customers. The process involves validating customer information, including personal data and identity documents, through trusted sources and third-party screening checklists.

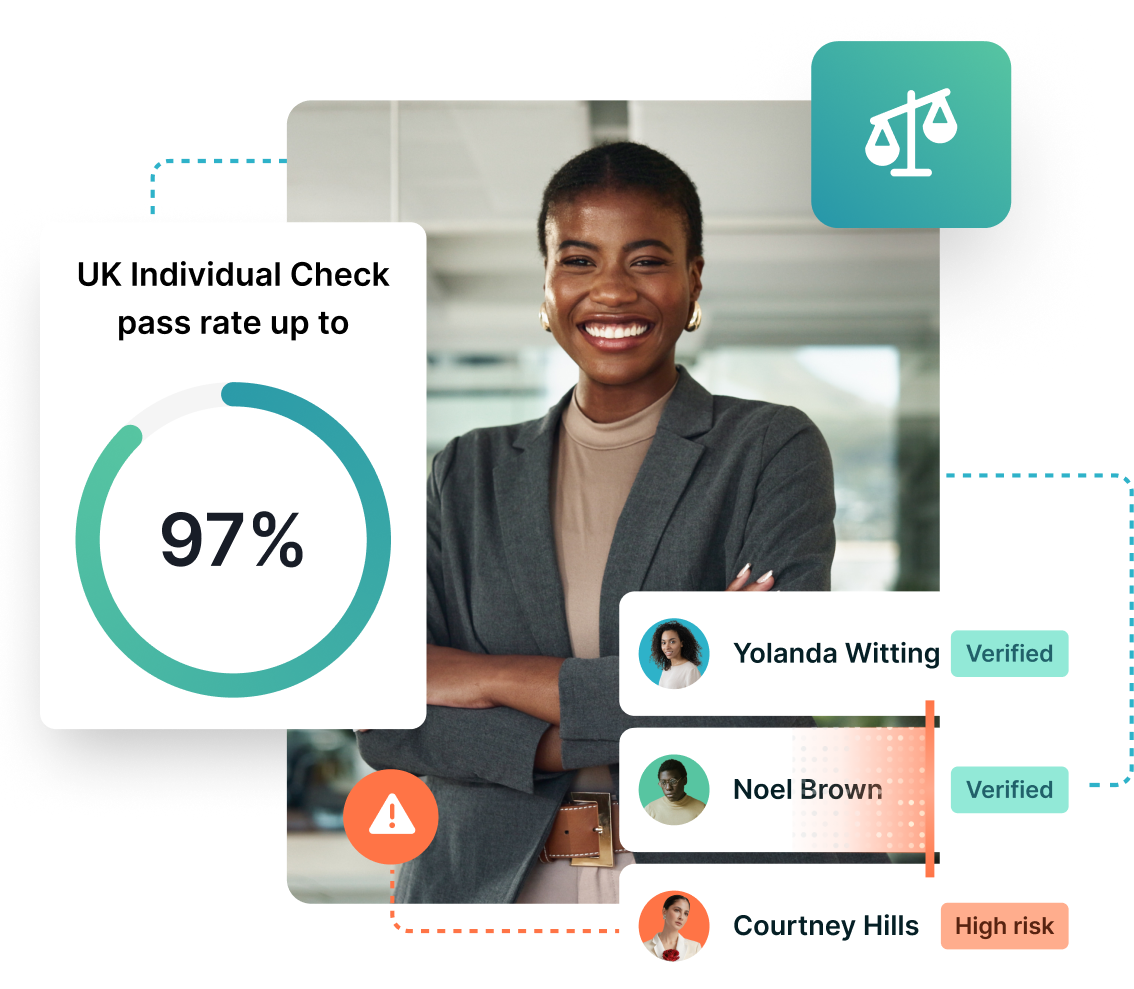

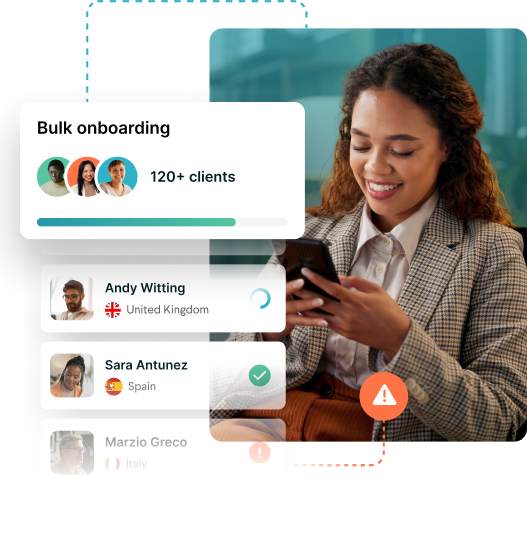

Our SmartSearch KYC system has a range of advanced features, including:

- Instant ID verification - Verify customers in seconds with automated biometric technology.

- Global data coverage with access to databases from over 200 countries.

- AI document validation, which automatically detects false or altered identity documents using liveness recognition.

- Sanction and PEP screening against thousands of global watchlists.

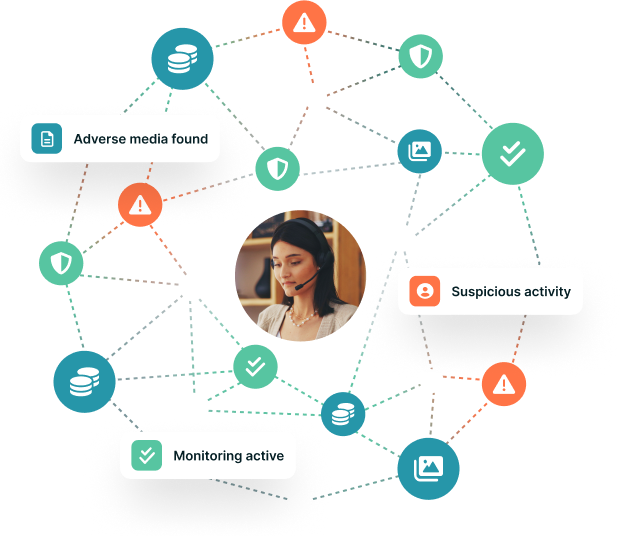

- Ongoing monitoring to keep track of customer transactions and risk profiles.

- Straightforward integration with other AML tools and software.

Reduce risk for your regulated firm with Perpetual Know Your Customer (pKYC)

When AML regulations apply, you need to conduct initial KYC checks and continue monitoring to detect any changes in the customer’s risk profile. Compliance involves periodic verification based on risk assessments. Switching to pKYC ensures ongoing compliance without frequent re-initiations, making the process more efficient.

Frequently Asked Questions

Perpetual KYC differs from a traditional KYC programme primarily in the sense that customer information is checked — and, as and when necessary, updated — continuously. This means that, if the customer’s status does change, you can be notified especially quickly.

If you are an AML-regulated UK business, you have a legal requirement to use proper due diligence processes in the course of Know Your Customer procedures. This means identifying and verifying the client before screening them against PEP lists and sanctions lists.

This umbrella term covers measures AML-regulated firms are legally required to take for preventing criminals from illegally concealing the source of funds obtained from illicit activities like corruption, gambling, and human trafficking.

This can be seen as an aspect of AML, as KYC checks are what a company performs to establish that customers or clients seeking to work with the business are genuinely who they claim to be.

The continual nature of pKYC requires it to be electronic. If you are still carrying out KYC processes manually, you can future-proof them by transitioning to electronic verification (EV).

Ensure your KYC provider encompasses all of the features you need. While some KYC providers might — for example — offer AML screening but omit the use of facial biometrics, SmartSearch’s innovative platform for AML compliance covers all aspects of KYC.

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.