TripleCheck is the only AML solution you will ever need

Introducing TripleCheck

TripleCheck is a pioneering new electronic KYC and AML solution that combines three highly sophisticated verification methods.

How does it work?

The most robust and reliable AML solution on the market

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Serving professional AML regulated industries

Trusted by over 7,000 regulated businesses, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management.

Ensuring Solicitors and Legal firms are AML compliant

- Benefit from industry-leading pass rates

- Enhance client relationships

- Protect your reputation

- Reduce compliance risk

Innovative AML solutions for Accountants

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

AML checks for Estate Agents & Property companies

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

Delivering AML compliance for Financial Services firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

-

Experience hassle-free AML and compliance

AML technology for Investment Banking

-

Benefit from industry-leading pass rates

- Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Insurance firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

Innovative AML solutions for Gaming firms

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance for Banking organisations

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Cryptocurrency firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance technology for Property Development firms

-

Experience hassle-free AML and compliance

-

Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

-

Streamline your onboarding process

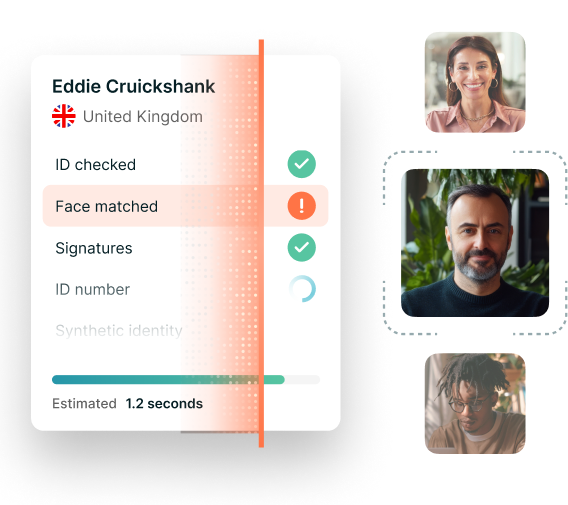

TripleCheck – a unique AML solution

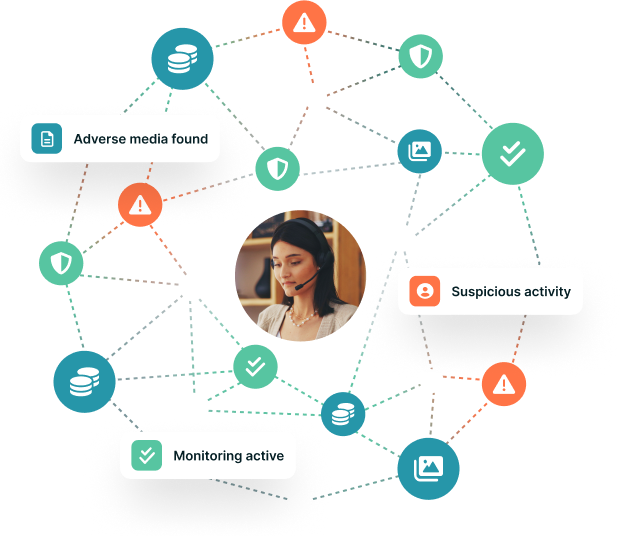

By bringing together all these elements - terrestrial data verification, AI document scrutiny with biometrics, SLV facial recognition and digital fraud checks – SmartSearch has created a highly advanced, robust and reliable identification and verification solution.

With TripleCheck, SmartSearch has combined its three most advanced technologies – market-leading AML checks, sophisticated facial recognition techniques and robust fraud checks - to create the most powerful and effective AML solution on the market.

Easy to use all-in-one platform

While the technology behind TripleCheck is highly advanced, the interface and outcomes have been designed with user-friendliness in mind, meaning staff at any level can successfully perform a SmartSearch TripleCheck.

An AML certificate will automatically be produced and stored on the central SmartSearch platform ensuring evidence of the check is always available, while our ongoing monitoring will check each record daily to ensure you remain compliant.

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.

/SmartSearch_OfficeLifestyle_Feb25_115%201.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115%201.jpg)