Streamlined AML Compliance

Anti-Money Laundering

In the UK, it’s compulsory to comply with anti-money laundering regulations. SmartSearch can help you carry out fast and accurate AML checks no matter what industry you’re operating in, whether it's in the finance, property, insurance or legal sector.

Controls against money laundering

We can create a tailor-made package to fit your needs and budget without compromising on functionality and service to ensure our unique AML solution is affordable to all businesses.

KYC Checks

KYC checks drastically reduce the risk of involvement with money laundering by confirming your customer’s ID.

KYC checks drastically reduce the risk of involvement with money laundering by confirming your customer’s ID.

Record Management

The maintenance of records and transactions is essential for internal security and for external audits.

The maintenance of records and transactions is essential for internal security and for external audits.

Holding Periods

A simple but effective concept, holding periods are used by many banks to reduce the risk of criminals “washing” their cash.

A simple but effective concept, holding periods are used by many banks to reduce the risk of criminals “washing” their cash.

RegTech

Regulatory technology (or RegTech) uses global databases and watch lists to run extensive checks and flag up anything suspicious.

Regulatory technology (or RegTech) uses global databases and watch lists to run extensive checks and flag up anything suspicious.

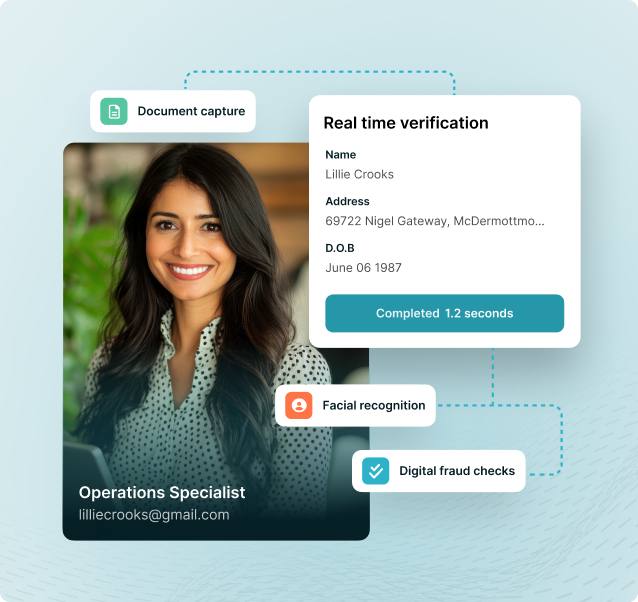

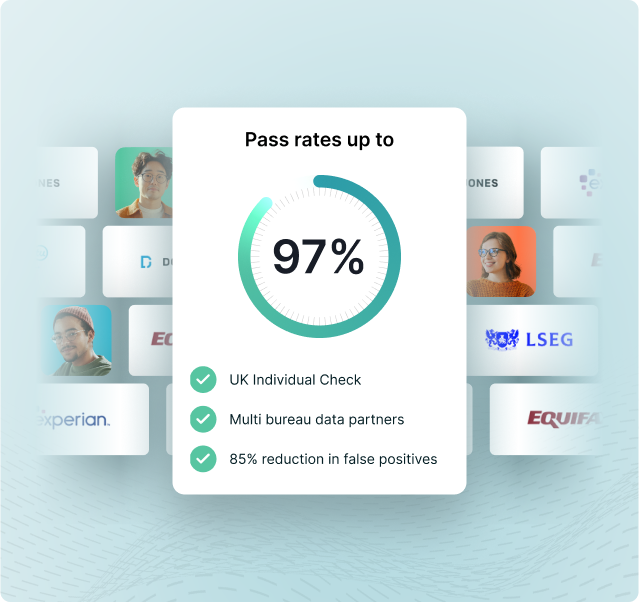

AML Checks Made Easy

All in all, SmartSearch is the go-to AML compliance platform built to easily verify clients that are based not only in the UK but on a global scale. Our platform has the following features that make anti-money laundering checks far easier:

- A convenient central hub for use in managing all aspects of KYC and due diligence

- Checking mechanisms that are more time and cost-effective than manual checking

- Access to more data and information in comparison to the competition

- Access to international data, allowing you to easily onboard overseas customers

- Industry-leading pass rate of up to 97%

What Are Anti-Money Laundering Checks?

Anti-money laundering checks — or ‘AML checks’, as they are often casually called — are, to a large extent, self-explanatory. They are indeed aimed at preventing money laundering. A business will often use AML checks to identify and verify prospective customers.

For the purpose of judging a customer’s money laundering risk and complying with AML regulations, businesses could check information about the following subjects:

- The customer’s name, residential address, and date of birth

- The corporate relationship’s purpose and intended nature

- The customer’s business or employment

- The source or origin of the customer’s funds

An All-in-One and Easy-to-Use AML Platform

SmartSearch offers an extensive AML compliance platform that would provide you with the functionality you need for completing AML screenings of all types. The AML checks you can make with SmartSearch technology include:

Want To See It In Action?

Book a discovery call with one of our AML experts to receive insights tailored to your specific compliance challenges.

/SmartSearch_OfficeLifestyle_Feb25_115%201.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115%201.jpg)

The Impact of The Latest ECCTA Regulations on AML Checks

In autumn 2025, the Economic Crime and Corporate Transparency Act (ECCTA) will come into force. This act will bring new identity verification requirements, making it essential for all directors and PSCs for new incorporations to verify their identity from the moment they join. It is hoped that the latest act will be a more potent combatant of fraud, giving greater governance and powers to prosecute acts of financial crime.

What Does This Mean For Your Company?

The latest ECCTA bill is being brought in to improve company transparency in aid of better combating financial crime. As a result, businesses may experience wide-ranging implications, with increased due diligence being the most significant change. Under the forthcoming legislation:

- From spring 2025, all directors and PSCs will have to verify their identity when setting up a company.

- Existing businesses will have a 12-month transition period wherein they’ll be expected to verify the identity of directors and PSCs when filing their new Confirmation Statement.

The Help You Need, Exactly When You Need It

Whether you’re a small business just getting to grips with AML regulations or a large corporation with plenty of experience in compliance, SmartSearch can help you to comply with regulations, fight financial crime and grow your business with confidence.

-

Case Studies

Explore case studies of how our clients have used our services to streamline their businesses and excel.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

What Are The Main Indicators of Money Laundering?

What would constitute warning signs that money laundering may be occurring? You should be particularly concerned if you notice any of the following when undertaking AML checks:

- New clients who refuse to answer questions about themselves.

- Unusual transactions.

- The movement of money between jurisdictions.

- An unusual company structure.

- Transactions involving high-risk countries.

- Customers who are subjects of negative news media.

Effortless Verification of Customers

At SmartSearch, we make it effortless to carry out your mandatory AML checks. Offering a variety of solutions that allow you to conduct comprehensive anti-money laundering checks to a high standard, we can help you perform your due diligence today and stay compliant going forward. Perform a complete anti-money laundering search that allows you to:

/SmartSearch_OfficeLifestyle_Feb25_063.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_063.jpg)

/SmartSearch_OfficeLifestyle_Feb25_063.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_063.jpg)

/SmartSearch_OfficeLifestyle_Feb25_063.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_063.jpg)

/SmartSearch_OfficeLifestyle_Feb25_063.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_063.jpg)

There’s a Reason Over 7,000 Clients Put Their Trust in Us

The onboarding process has allowed us to enhance our user experience, whilst improving compliance oversight without the need for manual intervention.

Audit & Compliance Manager, Acasta Europe LimitedThe ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.

Arena Investment ManagementThe SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.

Karen Hogan, Thorntons InvestmentsFrequently Asked Questions

According to the Financial Action Task Force (FATF) - the independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering and terrorist financing – Red Flags can be divided into four categories: client, source of funds, professional advice and the nature of the transaction.

AML checks, or Anti-Money Laundering checks, are a crucial part of the financial system and are required by various regulatory bodies around the world. These checks are designed to prevent money laundering, terrorist financing, and other illegal activities. The specific AML checks required may vary depending on the jurisdiction and the nature of the business.

Encouraged by both the FATF and the FCA, a risk-based approach requires that firms thoroughly assess the money laundering threat posed to their business and deploy an appropriate amount of resources to counter it. This is a proactive approach that should enable companies to detect and diffuse any risk of money laundering before it can take place, whilst using resources efficiently.

AML controls, also known as anti-money laundering controls, are measures put in place by financial institutions to detect and prevent money laundering activities. These controls aim to ensure that the institution is not unknowingly facilitating or participating in illegal financial transactions. AML controls typically involve the implementation of strict customer identification and verification procedures, monitoring of customer transactions for suspicious activities, and reporting of any suspicious transactions to the relevant authorities.