Customer Due Diligence Checks (CDD)

What we do

What is Customer Due Diligence and what is its objective?

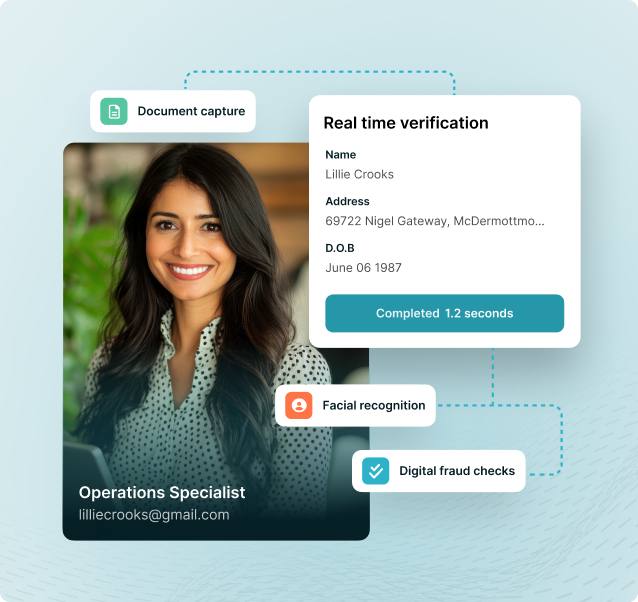

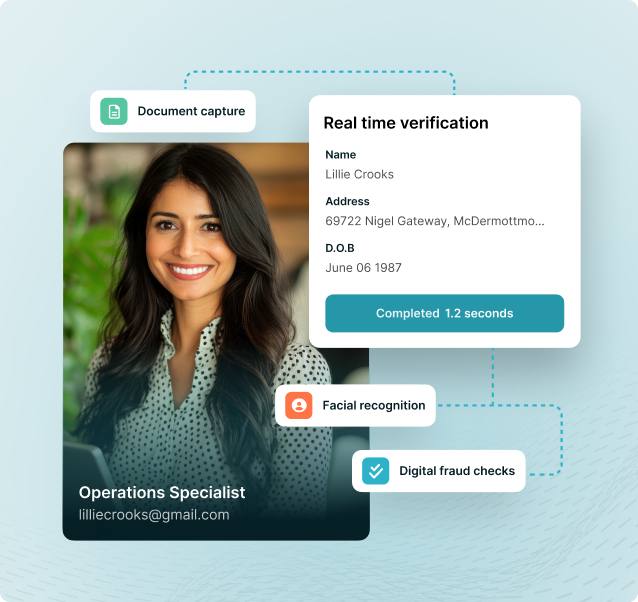

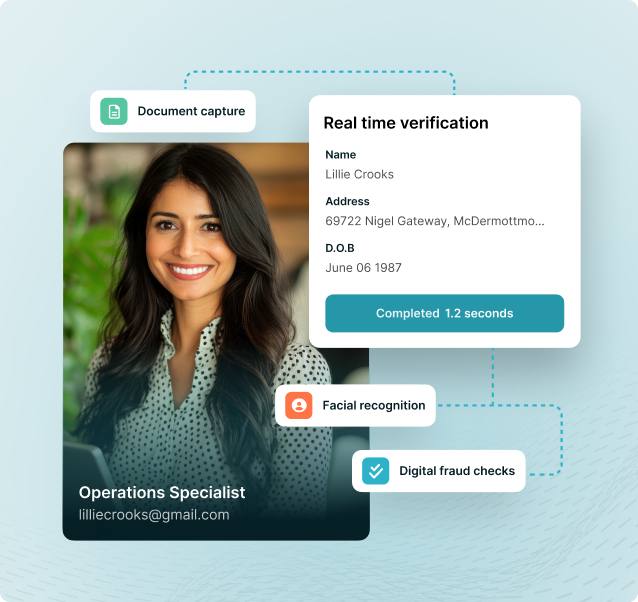

Customer due diligence (CDD) involves verifying a customer's identity through personal details like name, photograph, address, and date of birth, usually by accessing documents such as passports, driving licenses, or utility bills.

Customer due diligence (CDD) involves verifying a customer's identity through personal details like name, photograph, address, and date of ...

What CDD checks are needed for a business?

To carry out customer due diligence for a business, you’ll need to check the company is registered with Companies House, and identify any persons of significant control (PSCs). You’ll also need to find out if there are any ultimate beneficial owners, as well as look at the company's annual returns and statements.

To carry out customer due diligence for a business, you’ll need to check the company is registered with Companies House, and identify any ...

When is CDD required?

Customer due diligence is required at the onboarding stage, when your firm is in the process of bringing in a new customer. Every firm that’s subject to money laundering regulations should be performing CDD as part of their risk-based approach to AML.

Customer due diligence is required at the onboarding stage, when your firm is in the process of bringing in a new customer. Every firm ...

How are CDD checks performed?

Most firms still complete their customer due diligence manually. This involves checking physical ID documents to verify the person’s name, address and date of birth, and then checking that person’s details against sanctions and PEP lists.

Most firms still complete their customer due diligence manually. This involves checking physical ID documents to verify the person’s name, ...

Customer Due Diligence procedures are a core element of anti-money laundering regulations

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.

/SmartSearch_OfficeLifestyle_Feb25_115%201.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115%201.jpg)

What is a risk based approach to Customer Due Diligence?

Customer due diligence is required at the onboarding stage when your firm is bringing in a new customer. Every firm subject to money laundering regulations should perform CDD as part of their risk-based approach to AML. This not only includes all businesses in the financial services sector but also:

To effectively implement a risk-based approach, consider the following steps:

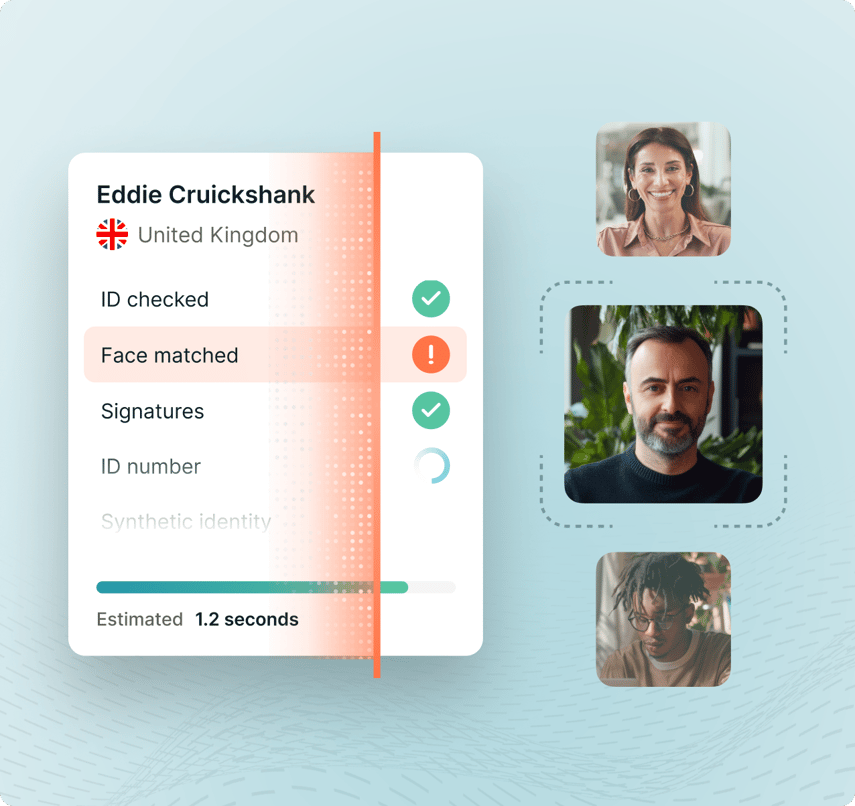

Begin by evaluating your firm's overall risk profile. This assessment should be detailed and reflect the unique characteristics of your business activities. Step 1: Verify Customer IdentitiesValidate your customer’s full name, residential address, and date of birth. Capture and confirm their photo identity against government-issued documents such as a passport or driving licence. Leveraging tools like identity and document verification, as well as facial recognition, can help streamline and automate this crucial first step.

Based on your risk assessment, determine the extent and depth of CDD required for each client. For higher-risk cases, more detailed information and verification steps will be necessary. Step 2: Screen Against Prohibited ListsCheck whether your client appears on Politically Exposed Persons (PEPs), sanctions, or fraud watchlists. Incorporating automated screening solutions helps ensure that no critical checks are missed and makes the process more efficient.

It's essential to maintain thorough documentation.This includes detailed records of your risk analysis and written policies outlining how your firm applies AML requirements to different risk levels. Step 3: Assess and Monitor RiskMake informed, risk-based decisions about each client by combining your CDD findings with other relevant insights. For higher-risk clients, ongoing monitoring and enhanced due diligence may be required. Access to consultancy services can help you develop a robust view of client risk and automate decision-making where appropriate.

By following these steps, your firm can not only meet regulatory requirements but also create a robust defence against potential money laundering activities. This approach ensures that CDD processes are not only comprehensive but also adaptable to the varying levels of risk presented by different clients.

Understanding the different levels of Customer Due Diligence

.png?width=855&height=855&name=UK%20Individual%20(2).png)

The help you need, when you need it

Whether you’re a small business just getting to grips with AML regulations or a large corporation with plenty of experience in compliance, SmartSearch can help you to comply with regulations, fight financial crime and grow your business with confidence.

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

There’s a reason over 7,000 clients put their trust in us

The onboarding process has allowed us to enhance our user experience, whilst improving compliance oversight without the need for manual intervention.

Audit & Compliance Manager, Acasta Europe LimitedThe ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.

Arena Investment ManagementThe SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.

Karen Hogan, Thorntons InvestmentsServing professional AML regulated industries

Trusted by over 7,000 regulated businesses, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management.

Ensuring Solicitors and Legal firms are AML compliant

- Benefit from industry-leading pass rates

- Enhance client relationships

- Protect your reputation

- Reduce compliance risk

Innovative AML solutions for Accountants

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

AML checks for Estate Agents & Property companies

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

Delivering AML compliance for Financial Services firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

-

Experience hassle-free AML and compliance

AML technology for Investment Banking

-

Benefit from industry-leading pass rates

- Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Insurance firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

Innovative AML solutions for Gaming firms

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance for Banking organisations

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Cryptocurrency firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance technology for Property Development firms

-

Experience hassle-free AML and compliance

-

Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

-

Streamline your onboarding process

What is the difference between customer due diligence (CDD) and know your customer (KYC) processes?

While KYC—‘Know your Customer’—is all about those initial checks before starting any business relationship (think of it as the screening process, like checking the guest list before the party starts), CDD goes a step further. Customer Due Diligence doesn’t just stop at onboarding; it includes continually assessing risk and monitoring the ongoing activities of your customers for anything unusual or suspicious.

So, in a nutshell:

- KYC covers those essential first steps to confirm a customer's identity.

- CDD builds on that foundation with regular reviews and monitoring to catch changes or risks as they arise.

Both are designed to keep businesses compliant and help spot financial crime—but CDD keeps an eye on things long after the welcome mat has been rolled out.

Streamlining Customer Due Diligence with SmartSearch

With SmartSearch, your Customer Due Diligence (CDD) process becomes a streamlined, efficient experience. Our advanced platform automates the identification and verification of customer information, ensuring compliance with AML regulations. By accessing a wide range of reliable data sources, including passports, driving licenses, and utility bills, SmartSearch helps you quickly and accurately verify customer identities, reducing risk and saving valuable time.

The Power of Automated Simplicity

Automating the majority of initial CDD checks not only accelerates the process but also helps pinpoint high-risk cases that require further investigation. This approach saves you time, reduces operational costs, and minimizes the risk of human error—allowing your teams to focus on more value-added tasks.

For low-risk customers, SmartSearch slashes processing times from hours to near real-time, enabling you to meet client expectations and engage them before competitors can. The result: better conversion rates, smoother onboarding, and a seamless journey for both your business and your customers.

Frequently Asked Questions

CDD should be conducted at the start of a business relationship and periodically reviewed. The frequency of reviews depends on the customer's risk level; high-risk customers require more frequent and thorough reviews compared to low-risk customers.

Enhanced Due Diligence (EDD) is an extended version of CDD, applied to high-risk customers. It involves more rigorous checks, ongoing monitoring, and a deeper understanding of the customer's activities to mitigate potential risks.

Non-compliance with CDD requirements can lead to severe penalties, including fines, reputational damage, and potential legal action. It can also result in regulatory scrutiny and loss of business opportunities related to trust and credibility.

You must retain records of Customer Due Diligence (CDD) documents and related evidence for a period of five years after the conclusion of a business relationship or a one-time transaction.