All-inclusive AML Solutions for Solicitors

Legal

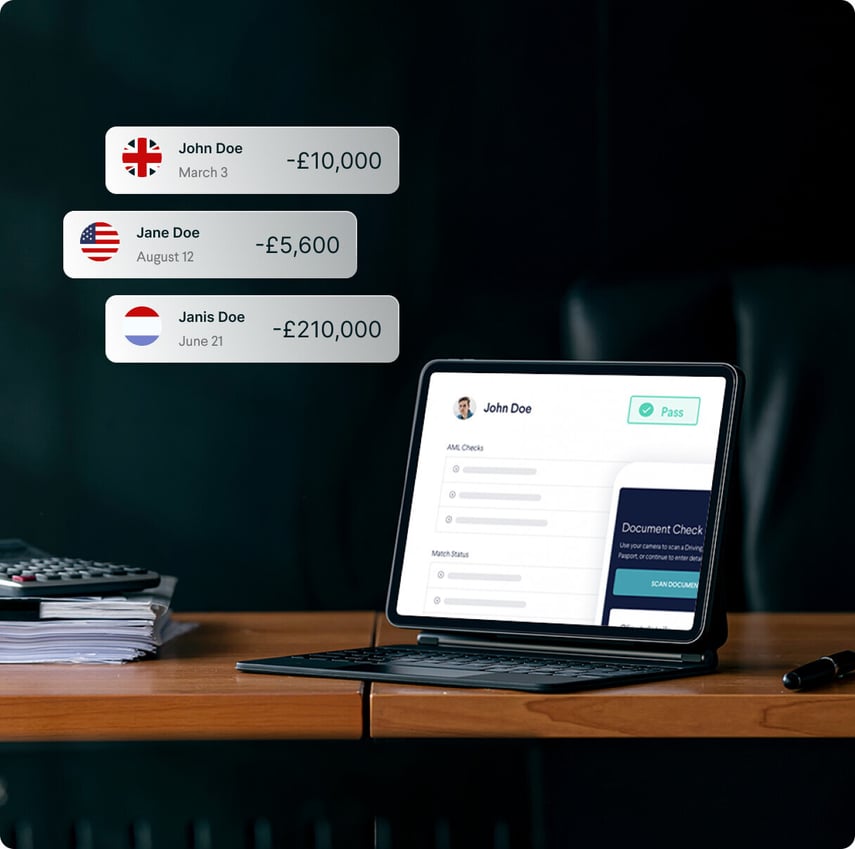

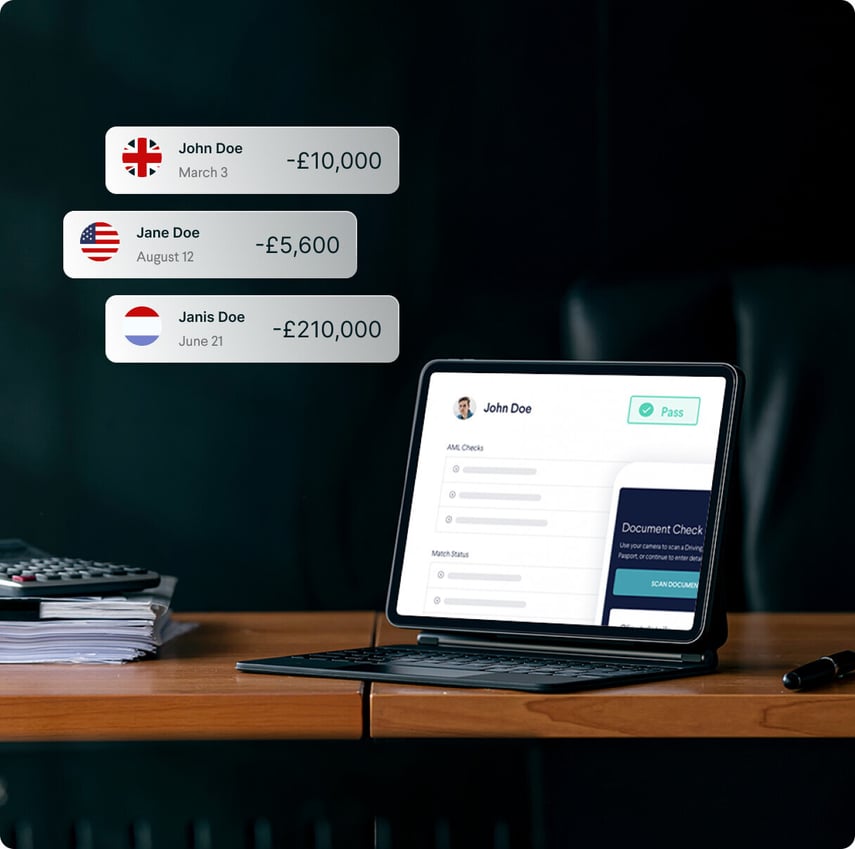

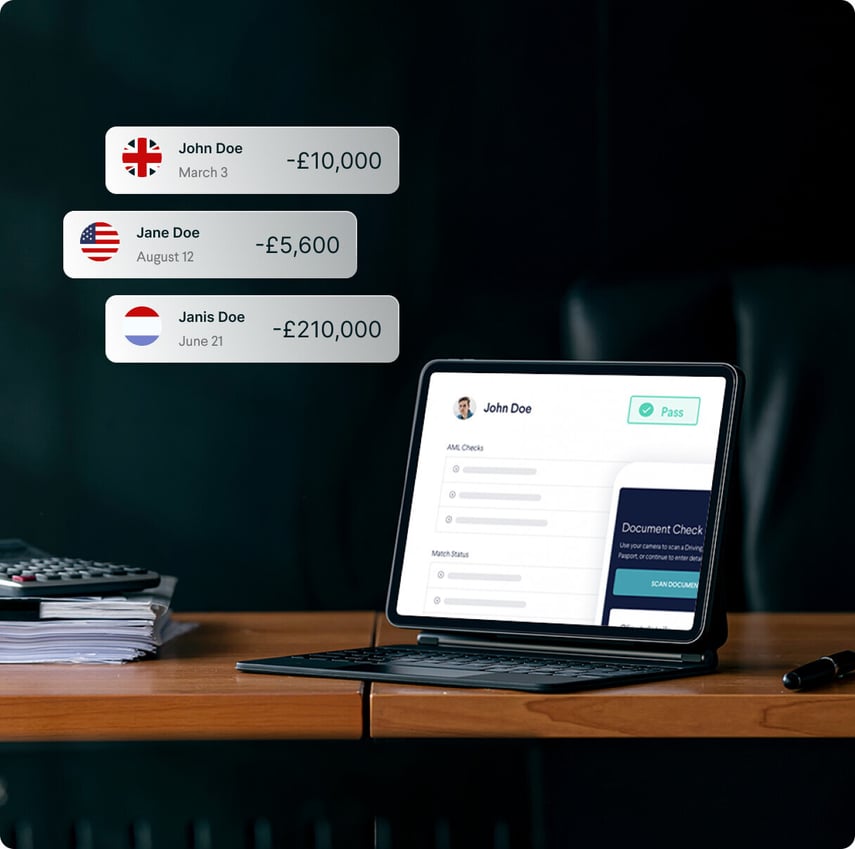

Protect your solicitors against financial crime and ensure compliance with AML regulations with our advanced anti-money laundering software. Our advanced system helps legal firms screen their clients and identifies high risk individuals, and protects your company against fraud, sanctions and legal penalties.

The SmartSearch Difference

Why your solicitors need AML

SmartSearch blends modern technology with legal-sector expertise to help AML checks for solicitors identify and prevent fraud. From ID verification to PEP screening and risk assessments, our system helps legal professionals meet AML obligations and protect clients and partners.

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Empower Your Firm with Secure Client Identities

-

KYC for legal industries

Ensure you know who you’re representing with Know Your Customer checks. This process instantly verifies identities and document authenticity to protect your reputation and comply with regulations effectively.

-

Verify corporate legal clients

For cases involving companies, Know Your Business checks offer verification on beneficial owners, directors and registered company details. KYB checks remove the need for lengthy manual investigations with automated document checks.

-

Onboard new clients with ease

Integrating our AML system into your legal processes is simple and allows you to conduct comprehensive checks without using valuable time and resources. Ensure compliance with automation and streamlined processes.

-

Ongoing monitoring for your clients

Continue to mitigate risks and monitor clients even after onboarding with automated alerts that highlight suspicious activity or changes in sanction status.

-

Stay compliant with legal due diligence

Our advanced tools screen all individuals and businesses involved in your legal processes, create automated risk assessments and conduct enhanced due diligence when suspicious activity or PEPs are discovered.

-

Fraud prevention for solicitors

Keep your business protected and maintain client trust with fraud prevention tools. Designed to support the legal sector, these processes detect suspicious activity, fraudulent documents and criminal history before damage is done.

Integrate SmartSearch’s capabilities into your own system

From KYC and sanctions screening to ongoing monitoring – you can access all our AML services in the holistic SmartSearch platform, but we know that flexibility is important. That’s why SmartSearch can integrate these products into your law firm’s software directly, to make AML checks for solicitors even easier, using existing files.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

Update your legal systems with SmartSearch

Identify customers in seconds

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Enhance client relationships

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Robust anti-money laundering protocols can help to enhance a client's faith in a company and their services.

Protect your reputation

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a company's reputation.

A company's most precious asset is its reputation and even accidental involvement in money-laundering or illegal transactions can harm a ...

Reduce compliance risk

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Avoid illicit activity that could expose your business to crime and criminal liability by screening their clients and transactions.

Our services are used by 1 in 3 of the top 200 law firms

.png?width=204&height=65&name=Lupton%20Fawcett%20(2).png)

The international corporate reports are brilliant, we would never be able to find the information on our clients as quickly or as easily as we do through SmartSearch. It is returned as a nice, easy to read PDF report with all the information clearly laid out, along with any PEP & Sanction matches.

Daniel Ayden

A number of other integrations based on RESTful APIs have been built but none so smoothly as SmartSearch. Their API, the accompanying (very detailed) documentation and the support received from Carl Chadwick and his colleagues is a country-mile ahead of others.

James Hood

Head of IT

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Frequently Asked Questions

Solicitors and law firms are often just as vulnerable to money laundering and other forms of financial crime as businesses in the financial services sector. The Financial Action Task Force therefore requires that solicitors meet AML regulations and carry out anti money laundering checks – this is monitored by the SRA (Solicitors Regulation Authority).

Short for designated non-financial businesses and professions, DNFBP is the acronym used to describe the additional occupations and industries which are legally obliged to comply with AML regulations, but don’t fit into the financial sector. Solicitors are a DNFBP, but so are estate agents, casinos, dealers in precious metals or stones, company service providers, tax advisors and external accountants.

Documents used to verify identity in AML checks must be certified by a reliable source. Some of the people who are qualified to certify these documents are: qualified lawyers or attorneys, accountants, licensed conveyancers, employees of the Homes and Communities Agency, and British Embassy or consulate staff.

Large sums of money, cross-border transactions, or clients from nations with significant risks of terrorism or corruption are characteristics of high-risk transactions. Purchasing real estate, forming trusts and companies, providing financial management and legal services are typical high-risk industries.

The Law Society is officially named as the supervisory authority for solicitors and law firms, but it has passed on all regulatory duties to the SRA, or Solicitors Regulation Authority. The SRA therefore monitors the compliance of solicitors and law firms in accordance with AML regulations.

The AML advice for the legal services industry is based on guidance published by the Legal Sector Affinity Group in 2018, as well as the 5th Money Laundering Directive, which arrived in January 2020. The compliance process includes carrying out a wide range of AML checks for solicitors, like sanctions and PEP screening, as well as checking for adverse media, performing ongoing monitoring and implementing a risk-based approach.

Serious consequences, such as hefty fines, criminal prosecutions, and reputational harm, can arise from failing to meet AML requirements. Partners and staff members of the company can occasionally be held personally accountable and a fraud or failure to comply can significantly damage the reputation of a company.

According to the Financial Action Task Force (FATF) - the independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering and terrorist financing – Red Flags can be divided into four categories: client, source of funds, professional advice and the nature of the transaction.

See it in action

If you’re ready to see how SmartSearch can streamline your AML procedures, get in touch with our team today or request a free demo of our system.