Unlock the Power of Configurability and Automation

Advanced AML & Compliance Solutions

Know who you're dealing with

Know who you're dealing with

We verify customer identities electronically in seconds, meeting KYC requirements and providing automatic enhanced due diligence for PEP or Sanction matches.

We verify customer identities electronically in seconds, meeting KYC requirements and providing automatic enhanced due diligence for PEP or ...

Onboard customers

Our platform performs AML checks in one place and integrates with your existing system, streamlining customer onboarding, enhancing client experience, and reducing costs.

Our platform performs AML checks in one place and integrates with your existing system, streamlining customer onboarding, enhancing client ...

Remain compliant

Through our user-friendly platform, identification, verification, and ongoing monitoring are quick and easy to perform, ensuring you always remain fully AML compliant.

Through our user-friendly platform, identification, verification, and ongoing monitoring are quick and easy to perform, ensuring you always ...

Monitor your clients and be audit ready

We continuously update from the Dow Jones watchlist to ensure you're instantly alerted to any changes in a client's PEP or Sanction status, keeping you fully AML compliant.

We continuously update from the Dow Jones watchlist to ensure you're instantly alerted to any changes in a client's PEP or Sanction status, ...

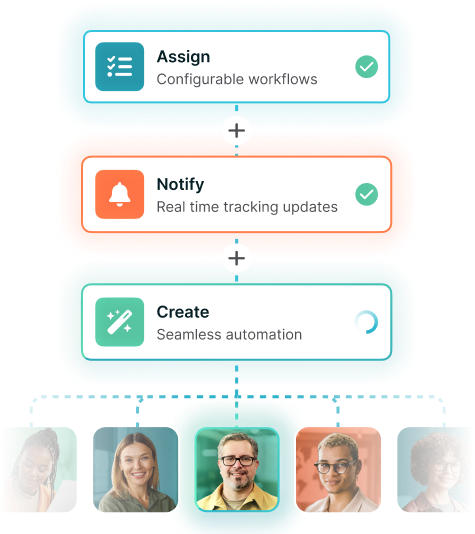

Gain enhanced configurability and flexibility for your organisation

In today's fast-paced world, AML compliance is crucial for businesses. As financial crime evolves, companies must stay ahead to protect themselves and their customers. SmartSearch's next-generation platform revolutionises AML efforts.

Harness the power of our latest innovations

Our Source of Funds service, which harnesses Open Banking technology helps provide regulated organisations like yours with a quick and easy way for their customers to share their financial data securely.

Issue a dynamic Risk Assessment questionnaire to your clients and benefit from a seamless, customisable, and additional layer of protection to your risk management processes, from pre-onboarding all the way through your client's lifecycle.

Customise and brand the SmartSearch platform for your clients throughout the mobile journey and emails. This approach minimises customer drop-off rates as clients will gain confidence when they see your brand associated with a request.

Our pKYC solution provides a holistic view of each search subject, reducing manual workloads by automatically re-running client searches and providing instant access to the latest search outcomes and audit trails to meet your KYC obligations with ease.

How workflows enhance the discovery of hidden risks

Workflows are pivotal in uncovering hidden connections and potential risks within vast datasets. By optimising these workflows, businesses can achieve a more comprehensive understanding of their data. Here's how:

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

There’s a reason over 7,000 clients put their trust in us

The onboarding process has allowed us to enhance our user experience, whilst improving compliance oversight without the need for manual intervention.

Audit & Compliance Manager, Acasta Europe LimitedThe ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.

Arena Investment ManagementThe SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.

Karen Hogan, Thorntons InvestmentsServing professional AML regulated industries

Trusted by over 7,000 regulated businesses, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management.

Ensuring Solicitors and Legal firms are AML compliant

- Benefit from industry-leading pass rates

- Enhance client relationships

- Protect your reputation

- Reduce compliance risk

Innovative AML solutions for Accountants

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

AML checks for Estate Agents & Property companies

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

Delivering AML compliance for Financial Services firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

-

Experience hassle-free AML and compliance

AML technology for Investment Banking

-

Benefit from industry-leading pass rates

- Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Insurance firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

Innovative AML solutions for Gaming firms

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance for Banking organisations

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Cryptocurrency firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance technology for Property Development firms

-

Experience hassle-free AML and compliance

-

Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

-

Streamline your onboarding process

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.

/SmartSearch_OfficeLifestyle_Feb25_115.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115.jpg)

Frequently Asked Questions

According to the Financial Action Task Force (FATF) - the independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering and terrorist financing – Red Flags can be divided into four categories: client, source of funds, professional advice and the nature of the transaction.

Encouraged by both the FATF and the FCA, a risk-based approach requires that firms thoroughly assess the money laundering threat posed to their business, and deploy an appropriate amount of resources to counter it. This is a proactive approach which should enable companies to detect and diffuse any risk of money laundering before it can take place, whilst using resources efficiently.

AML checks, or Anti-Money Laundering checks, are a crucial part of the financial system and are required by various regulatory bodies around the world. These checks are designed to prevent money laundering, terrorist financing, and other illegal activities. The specific AML checks required may vary depending on the jurisdiction and the nature of the business.

AML controls, also known as anti-money laundering controls, are measures put in place by financial institutions to detect and prevent money laundering activities. These controls aim to ensure that the institution is not unknowingly facilitating or participating in illegal financial transactions. AML controls typically involve the implementation of strict customer identification and verification procedures, monitoring of customer transactions for suspicious activities, and reporting of any suspicious transactions to the relevant authorities.