Have the confidence to verify clients globally with our comprehensive International Individual Checks

What we do

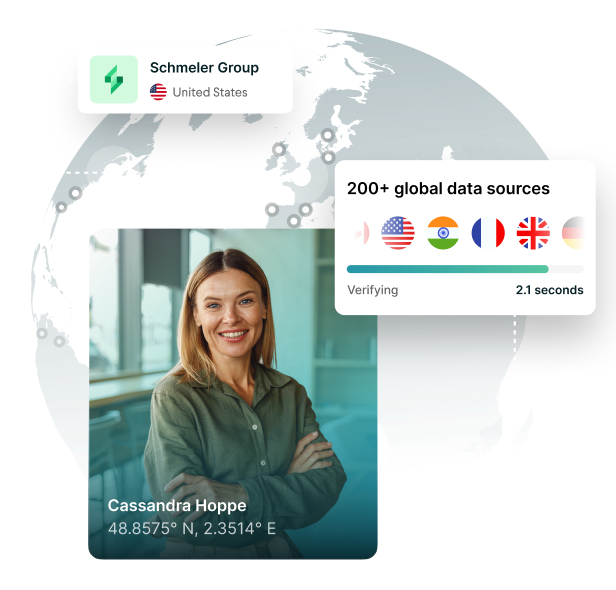

By leveraging cutting-edge technology, data analysis and global data partnerships, SmartSearch’s International Individual Check enables you to onboardand transact with clients from over 40 countries worldwide.

High-quality international data from over 200 global data sources

High-quality international data from over 200 global data sources

In-depth local knowledge

In-depth local knowledge

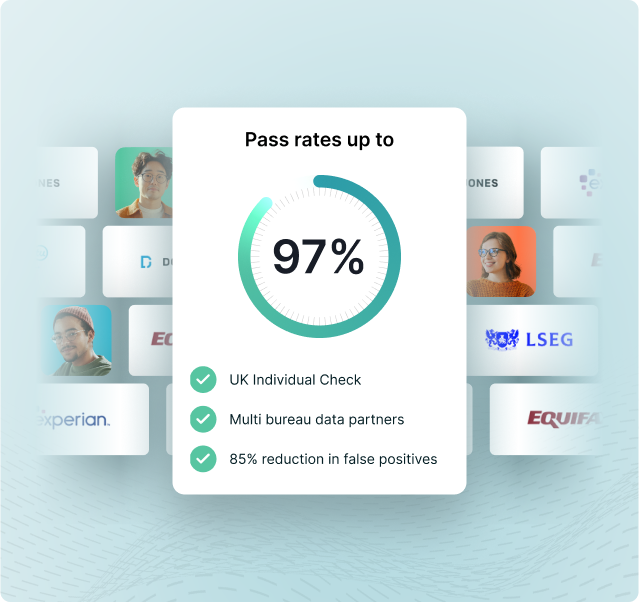

Robust and accurate verification of international individuals

Robust and accurate verification of international individuals

Global ID Verification made easy

.png?width=855&height=855&name=International-Individual-check-(21).png)

.png?width=855&height=855&name=International-Individual-check-(1650-x-1650-px).png)

The benefits of a SmartSearch International Individual Check

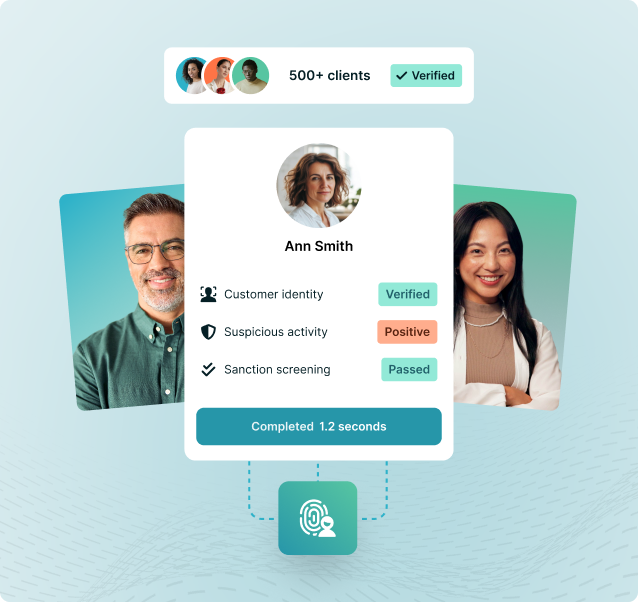

Results are received in a matter of seconds.

All checks can be completed through one centralised platform.

The International Individual Check produces a clear pass/fail result and easy-to-understand verification information in a standardised format across all countries.

International Individual Checks can be integrated into clients’ existing systems and with other SmartSearch solutions.

All SmartSearch solutions can be tailored to a client’s specific requirements.

The solution currently verifies over 40 different countries.

See it in action

What is an International Individual Check?

Regulated firms in the UK have a legal obligation to run comprehensive client due diligence checks on all new clients at onboarding, including identification, verification, screening for sanctions and politically exposed persons (PEPs) and enhanced due diligence if any risks are identified. This is called an individual check.

UK businesses must perform individual checks on all clients, but most verification platforms only offer this level of due diligence for UK-based individuals. An International Individual Check – also known as a global identity verification check - is a comprehensive AML compliance check that is able to verify an individual from outside of the UK.

We found that SmartSearch’s International Individual Check solution was very user friendly and that it very much mirrored that of a normal UK individual Search in terms of the ease of use, speed of results and the quality of the data returned. This solution will be a great asset for us when onboarding international clients in the future. We would be happy to recommend SmartSearch International Individual Check to other businesses.

Ben Leaney

Assistant Manager

SmartSearch’s Suite of AML and Compliance Solutions – Centralise your Compliance

The SmartSearch Individual International Check is part of a whole suite of digital AML and compliance solutions which includes:

Unlocking Global Opportunities

The SmartSearch International Individual Check is a game-changer in terms of identification and verification solutions because it enables UK businesses to expand their market reach beyond their domestic borders. Using the SmartSearch International Individual Check firms can onboard customers from all around the world safe in the knowledge they will be able to verify their identities accurately and securely, allowing them to grow their businesses with confidence.

The help you need, when you need it

Whether you’re a small business just getting to grips with AML regulations or a large corporation with plenty of experience in compliance, SmartSearch can help you to comply with regulations, fight financial crime and grow your business with confidence.

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Get the help you need

Our comprehensive range of AML and compliance solutions, including ID validation for UK and international clients can be tailored to your specific requirements to create a bespoke risk based solution.