Anti-Money Laundering

What we do

Anti-Money Laundering

What is Anti Money Laundering?

Money laundering is when criminals integrate their illegally obtained cash into the financial system, so it looks like it was earned legitimately. Anti-money laundering constitutes the laws, regulations, and procedures designed to prevent money laundering.

We can answer your questions about AML

The Money Laundering Control Act of 1986 is a United States Act of Congress that made money laundering a federal crime. It prohibits individuals from engaging in a financial transaction with proceeds that were generated from certain specific crimes, known as Specified Unlawful Activities (SUAs). There is no minimum value, the transaction does not need to involve a financial institution and the individual does not need to succeed in disguising the money for the action to be a crime.

The Bank Secrecy Act (BSA), sometimes referred to as Anti-Money Laundering law (AML) or jointly as BSA/AML is the US law that requires financial institutions in the US to detect, deter, prevent and disrupt money laundering activity and terrorist financing networks. Every financial institution must have a written, board-approved AML program to comply with the BSA. In 2001, The US Patriot Act amended the BSA, requiring financial institutions to maintain more formal AML programs requiring certain types of financial institutions to use a Customer Identification Program (CIP) with risk-based approach. More recent amendments to the BSA include the Customer Due Diligence (CDD) Final Rule which was implemented in 2018 and requires financial institutions to identify and verify the beneficial owners of companies opening accounts, and the Anti Money Laundering Act 2020 (AMLA ), which requires reporting companies to disclose beneficial ownership information. Both amends aim to stop criminals using shell companies to hide their identities and launder money.

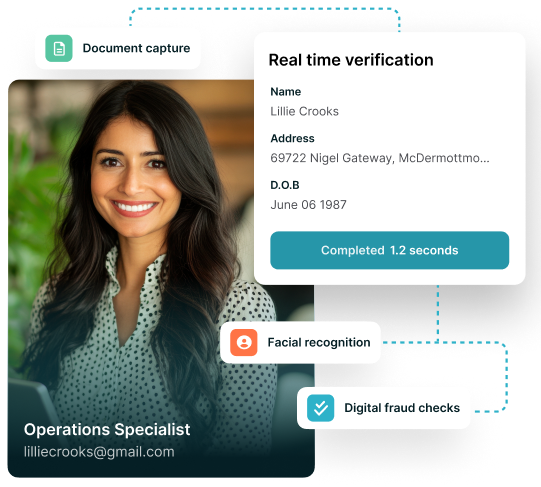

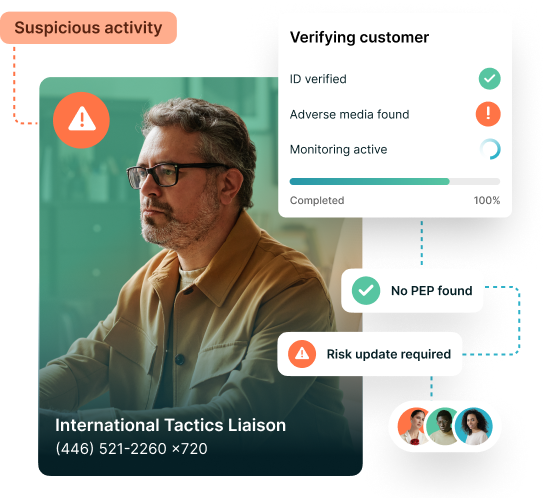

To comply with the BSA, all financial institutions must have a Customer Identification Program (CIP) in place and use a risk-based approach to verify the identity of all customers - both individual and corporate - to ensure they are who they say they are. This includes keeping a record of the information used to verify the person or business’ identity, and whether they appear on any Sanction list. The BSA act requires financial institutions to have internal control systems in place for ongoing compliance of the business relationship and a Compliance Officer who is responsible for coordinating and monitoring day-to-day compliance and providing AML training to all appropriate personnel. Any suspicious activity must be reported to the Financial Crimes Enforcement Network (FinCEN) if found.

Failure to comply with BSA/AML laws has severe consequences. Any individual found guilty of willful BSA violations is subject to criminal fines of up to $250,000 or five years in prison, or both. If the individual willfully violates BSA regulations while also breaking another law or committing other criminal activity, they are subject to a fine of up to $500,000 or ten years in prison, or both. Institutions that violate BSA rules can be subject to a fine of up to $1 million or twice the value of the transaction, whichever is greater. The federal banking agencies and FinCEN also have the authority to bring civil penalty actions. They can remove individuals and institutions from banking and can issue fines of hundreds of millions of dollars.

We can help you stay compliant

The SmartSearch platform is a one-stop-shop for all your AML requirements. Our user-friendly system means team members at any level can perform identification verification KYC checks easily and effectively and, thanks to the fully integrated app, can run checks remotely too. The details of each customer you identify, verify and screen will be automatically saved into the system to ensure watertight record-keeping, meaning you only need one system for all your CIP and Customer due diligence need. What’s more, the platform is constantly updated and improved to ensure you never have to upgrade to remain compliant.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.