KYC verification doesn’t have to be complicated

Cost-effective and fully comprehensive AML-client checks in less than 2 seconds

Join us today!

Know Your Customer is quicker, easier and more effective than ever thanks to the SmartSearch all-in-one Customer Identification Program. Run global identity verification checks with sanction and PEP screening in seconds to improve customer onboarding, comply with regulations and reduce fraud.

WHAT WE DO

Individual and business KYC checks made easy

Are your customers who they say they are? How can you be sure?

With SmartSearch you can be certain.

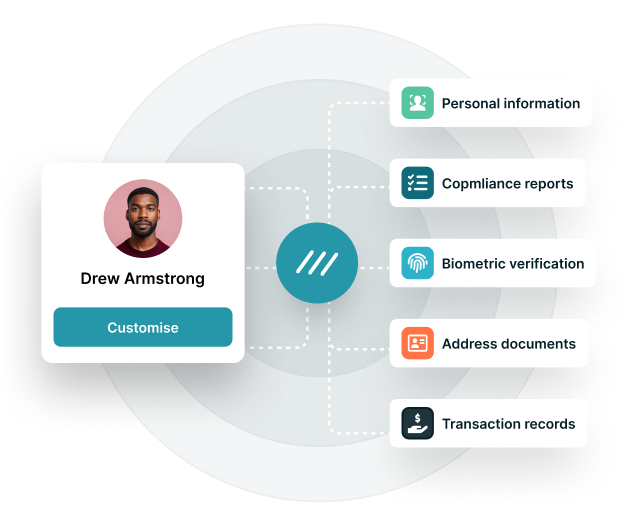

Our innovative online Customer Identification Program (CIP) enables financial institutions to onboard customers, fight fraud and meet KYC due diligence requirements, all from one platform.

The SmartSearch CIP identifies and verifies customers, screens against sanctions and PEPs and automatically triggers enhanced due diligence on any positive matches.

Financial institutions can also run checks on corporations with our business reporting service - just enter the name and zip code and SmartSearch will confirm the existence of the business, identify and verify its executives and owners and validate the corporate structure.

SmartSearch hosts all search data automatically, while our ongoing monitoring service ensures clients only ever need one CIP platform to onboard customers quickly and securely and maintain a risk-based AML program.

- US and International KYC checks on individuals and corporates

- Identify and verify Ultimate Business Owners

- Sanctions and PEP screening on all checks

- Adverse media and enhanced due diligence

- Customer data hosting and ongoing monitoring

WHAT WE DO

TripleCheck - Identity verification, facial recognition, and digital fraud checks in one solution

By using three highly advanced identity verification methods, TripleCheck takes KYC to a new level to provide you with the only Customer Identification Program you will ever need.

Our pioneering solution combines identification, verification and screening with facial recognition and liveness tests and digital fraud checks to create the most robust, reliable and secure all-in-one CIP, KYC, AML anti-fraud platform on the market.

- Level 1

Identification verification ensures the customer’s details are legitimate and automatically screens against worldwide sanctions and PEP lists to identify bad actors

- Level 2

Facial recognition, document capture and liveness checks confirm the customer and their documents match, reducing ID-fraud and ensuring you know exactly who your customers are

- Level 3

Digital fraud checks and data referencing creates an overall fraud risk profile of each and every customer

HOW WE DO IT

KYC made easy

US AML rules are constantly changing, and it can be challenging to keep pace with all the latest requirements, but with SmartSearch you never need to worry about being caught out. Our easy-to-use online CIP platform makes running KYC checks easy, but not only that, it hosts all search data and checks it every night against the Dow Jones WatchList to ensure a fully compliant position at all times.

SmartSearch uses multiple data sources to verify identities and screen for bad actors, while the latest facial recognition and liveness technology gives financial institutions the confidence that your customers are who they say they are.

What’s more, the platform is constantly being updated to ensure it meets the latest regulations meaning you never have to worry about updating your system to meet requirements.

Serving financial institutions across the US

We can help you to…

Meet BSA regulations

Our platform helps financial institutions understand FinCEN anti money laundering requirements ensuring they take a risk-based approach to meet BSA, CCD Final Rule, AMLA and USA Patriot Act obligations.

Our platform helps financial institutions understand FinCEN anti money laundering requirements ensuring they take a risk-based approach to ...

Verify Identities

SmartSearch identifies and verifies customers, screening for sanctions and PEPs and then automatically runs enhanced due diligence if any warnings are highlighted, ensuring you are always aware of any potential risks to your business.

SmartSearch identifies and verifies customers, screening for sanctions and PEPs and then automatically runs enhanced due diligence if any ...

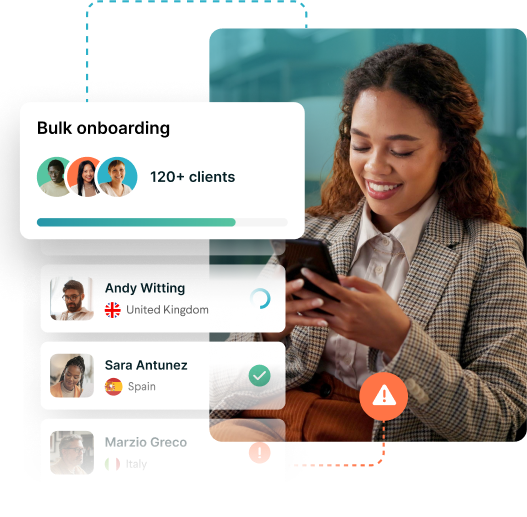

Onboard customers

SmartSearch can be integrated with your existing CIP and you can run KYC checks from your cell phone or tablet, enabling you to complete the required customer due diligence at onboarding, cutting costs, saving time and improving customer experience.

SmartSearch can be integrated with your existing CIP and you can run KYC checks from your cell phone or tablet, enabling you to complete ...

Automatic data hosting

Every KYC search you complete is automatically hosted on the system to ensure water-tight record keeping. We can even retrospectively upload client data to your CIP to ensure there are no gaps in your compliance record.

Every KYC search you complete is automatically hosted on the system to ensure water-tight record keeping. We can even retrospectively ...

Monitor clients

Initial identity verification, screening and KYC checks are essential, but they are not enough to stay compliant - you also need to be aware of any changes in the risk profile of your customers. That is why SmartSearch monitors all search data every night to guarantee a fully compliant CIP.

Initial identity verification, screening and KYC checks are essential, but they are not enough to stay compliant - you also need to be ...

Prevent fraud

SmartSearch offers a range of anti-fraud services that can be tailored to any financial institution’s needs, while our facial recognition and liveness technology checks ensure ID fraud is never an issue.

SmartSearch offers a range of anti-fraud services that can be tailored to any financial institution’s needs, while our facial recognition ...

Identify bad actors

Our comprehensive KYC program enables you to identify and verify customers, using the latest facial recognition and liveness technology to ensure the ID matches the person. We then screen against sanctions and PEPs to weed out any bad actors.

Our comprehensive KYC program enables you to identify and verify customers, using the latest facial recognition and liveness technology to ...

Identify Ultimate Business Owners

The SmartSearch business checks service not only enables you to run KYC checks on corporate customers but can also identify and verify the Ultimate Business Owners ensuring financial institutions know exactly who they are transacting with.

The SmartSearch business checks service not only enables you to run KYC checks on corporate customers but can also identify and verify the ...

There’s a reason we have a 98% client retention rate

Our processes have been streamlined; we get all the information we need in one search and we no longer need to take so much time to connect the dots. We are always kept up to date with the latest developments. It is good to know they are always looking to help and simplify things for us, particularly with updates such as API integration. This is an excellent idea and would benefit many businesses to use a familiar system. We would recommend SmartSearch as an AML provider.

Martina Hopgood, Client liaison at US Tax and Financial Services

We’re most impressed with the service provided by SmartSearch. As a global business, we place high importance on our ability to identify all our clients. The [ongoing] monitoring service provides peace of mind that we are fully compliant with our legal obligations and the enhanced screening for Sanctions and PEPs provides added screening throughout the client journey. This is an excellent service and we are only too happy to recommend.

Ken Deamer, Director at Jones Lang LaSalle LtdSee it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product