What is an adverse media check? | SmartSearch

Financial rules and regulations are ever-changing, and businesses need to be educated and adaptable to new AML processes. It\u2019s also any financial...

It is a legal requirement and your responsibility to carry out AML checks on all onboarding UK businesses, with our SmartSearch tool simplifying this process.

At SmartSearch we deliver detailed AML checks for UK businesses that include everything you need to fulfil your legal obligations. Our simple platform allows you to comprehensively screen businesses, creating concise reports that are detailed with essential information.

Our essential KYB checks that allow you to gain insight into the individuals behind a business facilitate the start of your robust AML process.

Our essential KYB checks that allow you to gain insight into the individuals behind a business facilitate the start of your robust AML ...

Identify the Ultimate Beneficial Owner (UBO), an essential part of your compliance effort.

Identify the Ultimate Beneficial Owner (UBO), an essential part of your compliance effort.

Carry out a full AML check on a business director using our all-in-one solution, saving you time and effort.

Carry out a full AML check on a business director using our all-in-one solution, saving you time and effort.

Monitor the status of your client with our comprehensive AML platform that assesses whether a business may carry future risks to your company.

Monitor the status of your client with our comprehensive AML platform that assesses whether a business may carry future risks to your ...

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.

Explore our useful resources and insights, including whitepapers that provide essential information about how to tackle AML obstacles.

AML regulations are ever-changing, especially if you’re working in contemporary technological sectors such as the cryptocurrency industry. Explore our blog to keep up to date.

Discover more about how our products and services can help you and your business streamline your AML compliance.

The onboarding process has allowed us to enhance our user experience, whilst improving compliance oversight without the need for manual intervention.

Audit & Compliance Manager, Acasta Europe LimitedThe ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.

Arena Investment ManagementThe SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.

Karen Hogan, Thorntons InvestmentsTrusted by over 7,000 regulated businesses, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management.

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Experience hassle-free AML and compliance

Benefit from industry-leading pass rates

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Benefit from industry-leading pass rates

Accelerate your customer onboarding without compromising on compliance

Deliver a frictionless customer journey

Experience hassle-free AML and compliance

Benefit from industry-leading pass rates

Streamline your onboarding process

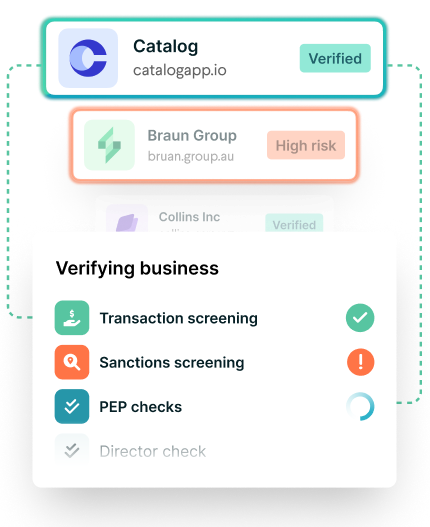

A business AML check is a legal requirement when onboarding new clients that aid in the national effort against money laundering and assesses a company’s potential risk. In addition to ID checks, this process should involve evaluating new clients against International sanctions lists, PEP Lists and SIP Lists, with Enhanced Due Diligence checks being used where necessary.

We make it as easy as possible for your team to understand our platform, no matter how large your business is. We’ve put effort into streamlining our product too, offering a tailor-made training package and a simple user-friendly interface that allows our platform to be effortlessly integrated as part of your everyday workflow.

Keep in the know about any changes to AML regulations by checking in with our blogs and whitepapers.

Still after more information about UK Business AML checks? Explore our FAQs below or contact us directly if you can’t find the answer you’re looking for.

AML is short for ‘Anti-Money Laundering’ and is used as an acronym across the financial industry. Our AML solution allows you to adhere to essential practices, keeping you compliant with legal requirements with a simple, efficient and highly optimised product.

Suspicious AML activity should be reported through the use of a suspicious activity report (SAR). This report is crucial in the process of financial crime investigation and will inform the relevant authorities about the suspicious behaviour of a client or customer.

Financial rules and regulations are ever-changing, and businesses need to be educated and adaptable to new AML processes. It\u2019s also any financial...

In the modern financial world, it\u2019s more important than ever for institutions to have effective processes for fighting financial crime. Stricter...

Artificial intelligence is transforming the way many industries work, particularly the financial sector. New systems have been introduced that utilise...

Want to discover the benefits that SmartSearch could bring to your business? Get in touch for…