As The World Toughens Sanctions On Russia Businesses Are Advised To Update Screening Procedures

- Sanctions & PEP Screening

By SmartSearch

Businesses across the world need to ensure their customer screening processes are up to date after the extensive new sanctions against Russia following its invasion of Ukraine.

The U.S Department of the Treasury’s Office of Foreign Assets Control (OFAC), the UK Government’s Treasury department along with allies across the EU have imposed expansive economic measures that target the core infrastructure of the Russian financial system.

The new sanctions include all of Russia’s largest financial institutions - including preventing Russia’s central bank from accessing foreign assets abroad, meaning it cannot support its own currency. There are also new sanctions against individuals, including limits on deposits held by Russian nationals in UK, US and European bank accounts, and a ban against the export of a range of high-end and critical technical equipment.

The sanctions have been described by British prime minister, Boris Johnson, as the “largest and most severe package of economic sanctions that Russia has ever seen” while the US Secretary of the Treasury Janet L. Yellen said “The unprecedented action we are taking today will significantly limit Russia’s ability to use assets to finance its destabilising activities, and target the funds Putin and his inner circle depend on to enable his invasion of Ukraine.”

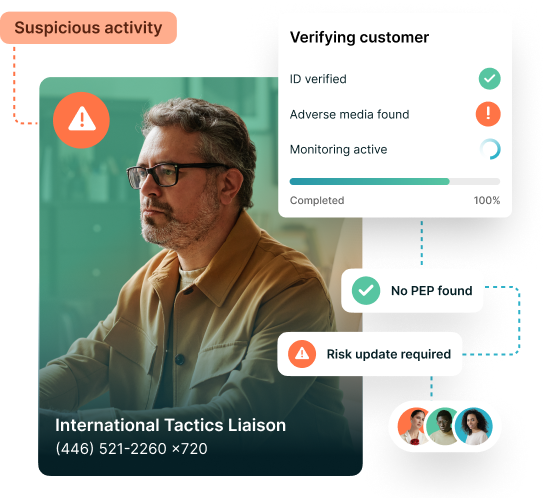

Anti-money laundering specialists SmartSearch is urging regulated firms in the UK and financial institutions in the US to ensure they have robust sanctions screening in place to guarantee they are complying with the new - and continually changing - sanctions rules.

Collette Allen, client services director at SmartSearch said: “These sanctions are extensive, and have implications for businesses across the world. Not only are companies banned from making funds or other economic sources available to sanction targets, but they also cannot deal with intermediary financial institutions through which funds could pass.

“In order to avoid breaching sanctions, businesses should be undertaking fresh due diligence and screening to ensure that they are not transacting with individuals or organisations that are subject to the new sanctions.

“Any firms found to have contravened the sanctions brought in against Russia by the UK and US governments could face action, including hefty fines - from regulatory organisations such as Office of Financial Sanctions Implementation (OFSI) in the UK and OFAC in the US - or even prison time.”

SmartSearch can help any businesses worried about the new sanctions with its electronic screening and monitoring service, as Allen explains:

“Businesses cannot rely on sanctions checks done at an earlier date - fresh checks must be run now to verify if any clients are now on sanctioned lists.

“The best way to do this is to use an electronic verification platform with a monitoring system. For example, the SmartSearch platform provides alerts if any person or entity already on the system is among those targeted by the new sanctions. SmartSearch takes updates from Global Watchlists - including OFAC - every night, meaning clients’ customer databases are always up to date and compliant.

“We can set firms up onto the SmartSearch system within 24 hours and screen their entire customer database for sanctioned individuals and then continue to monitor it daily for any changes.

“The latest developments in Russia show that businesses cannot rely on old-fashioned customer onboarding methods, as they fail to ensure proper screening against sanctions and PEP lists. All businesses need to adopt a system that is able to constantly monitor for status changes following the introduction of new sanctions, so they are able to immediately cease any transactions linked to flagged individuals or entities.”

To find out how to ensure your businesses is fully compliant with new sanctions, visit www.smartsearch.com

See it in action

Book a personalised demo with an AML expert today!