Anti Money Laundering Checks For Property Developers and Firms

Property Development

SmartSearch understands that every business is unique, which is why we offer customisable solutions tailored to meet the specific needs of property firms. Whether adjusting risk thresholds or integrating with existing systems, our cost-effective AML platform is constantly being updated to meet the latest regulations.

Streamline your customers’ AML checks when buying a house, fulfil your own AML obligations and give yourself more time to focus on your business, all with SmartSearch.

The SmartSearch Difference

From customer onboarding to ongoing monitoring, SmartSearch streamlines the compliance workflow, allowing businesses to focus on their core activities without compromising on regulatory obligations.

Solutions for Property Developers

We are committed to helping our clients achieve their goals through secure and efficient solutions

-

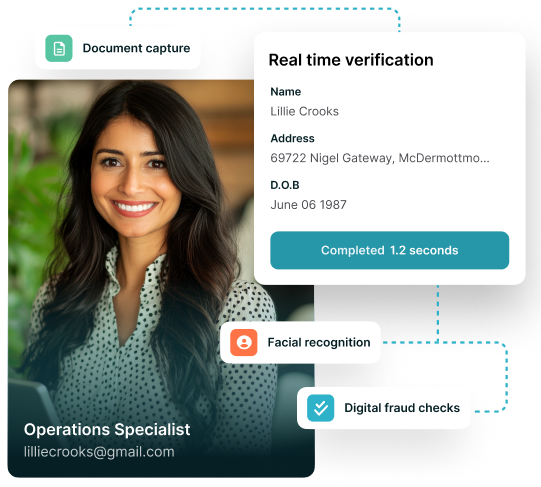

Know your customer

SmartSearch can quickly and reliably identify and verify individuals and businesses looking to purchase properties to ensure they are who they say they are, and not bad actors committing ID theft or transacting under fake properties.

-

/SmartSearch_OfficeLifestyle_Feb25_086.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_086.jpg)

Instant approvals

We utilise triple-bureau data from the UK's leading data suppliers, Experian, Equifax and TransUnion to deliver an industry-leading pass rate of up to 97%, meaning you can onboard customers in a matter of seconds.

-

Automatic screening

SmartSearch's all-in-one system not only identifies and verifies your buyers but, using global watchlists, also automatically screens them for PEPs and sanctions, running enhanced due diligence on any matches.

-

Biometric technology

Our advanced system uses the latest biometric and OCR technology, enabling you to onboard customers even if you can't see them face-to-face. Once you have onboarded a new customer and the result has been uploaded, it is then checked every night for any changes to ensure ongoing compliance.

-

Check suppliers and customers

Our AML solution can check individuals and businesses all from one place, meaning you can check your customers, suppliers, and any other agents you are working with all from one system, which can be accessed remotely via the app, meaning you can run reliable KYC and KYB checks anytime, anywhere.

-

Proof and source of funds check

Simplify your conveyancing process by verifying the legal origins of your customer's funds and ensuring that they are in a financial position to complete the relevant transaction.

Integrate SmartSearch’s capabilities into your own system

From identification and verification, to screening, monitoring and record keeping, we offer the most reliable and robust AML, compliance and fraud prevention solutions on the market. Each product in our suite of solutions can be tailored to your firm’s individual compliance needs.

Our cloud-based software can be integrated into your existing systems, making customer onboarding simple and removing the risk of error through re-keying of customer data.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

Protect Your Property Development Firm With SmartSearch

AML compliance is essential for maintaining the integrity and reputation of your firm as well as meeting regulatory requirements. Implementing our robust SmartSearch AML checks helps to:

Identify customers in seconds

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Our AML and compliance platform offers triple-bureau reliability for the highest pass rate on the market of up to 97%.

Enhance client relationships

Robust anti-money laundering protocols can help to enhance a client's faith in a company and its services.

Robust anti-money laundering protocols can help to enhance a client's faith in a company and its services.

Protect your reputation

A company's most precious asset is its reputation, and even accidental involvement in money laundering or illegal transactions can harm it.

A company's most precious asset is its reputation, and even accidental involvement in money laundering or illegal transactions can harm it.

Reduce compliance risk

Avoid illicit activity that could expose your business to crime and criminal liability by screening your clients and transactions.

Avoid illicit activity that could expose your business to crime and criminal liability by screening your clients and transactions.

Identify the AML Red Flags

SmartSearch allows you to easily identify money laundering red flags, so that you can complete robust AML checks on customers when they’re buying property. Some of the most significant AML red flags include:

/SmartSearch_OfficeLifestyle_Feb25_042.jpg?width=951&height=633&name=SmartSearch_OfficeLifestyle_Feb25_042.jpg)

Property Regulation Changes

From May 14th, 2025, new AML and financial sanctions legislation for property agents in the UK will come into effect.

- Since January 2020, letting agents handling properties with monthly rents of at least £10,000 have been subject to AML regulations.

- These regulations involved being registered with HMRC, conducting CDD checks and reporting suspicious transactions.

The new regulations, as of May 14th, 2025, bring the following changes:

- Letting agents will be required to carry out EDD and monitor systems.

- They will also be expected to train staff to identify AML red flags and report financial sanctions breaches, no matter whether transactions are related to landlords, tenants, or other parties.

- Letting agents must report reasonable suspicion of financial sanctions breaches to the Office of Financial Sanctions Implementation (OFSI).

Compliance with these new sanctions helps to fix the vulnerability of the previous regulations and safeguards the ongoing integrity of the financial system. SmartSearch can help you effortlessly pivot to these new regulations with:

- Automated Sanctions Screening: Earn immediate and clear ‘pass or refer’ results.

- Continuous Monitoring: Ongoing monitoring of clients against the updated sanctions list to make sure you’re constantly compliant.

- Regulatory Confidence: By automating our processes, you can significantly reduce the chance of human error.

There's a reason over 7,000 clients put their trust in us

The team find the system incredibly easy to navigate and understand and we rarely get any queries from the users who run searches. We mainly use the UK individual and SmartDoc searches and these verify our customers address and ID in seconds, giving us complete confidence that they are who they say they are with minimal fuss.

Rochelle Edwards

Poole Townsend

Utilise all of our resources

-

Case Studies

Explore case studies of how our clients have used our services to streamline their businesses and excel.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Frequently Asked Questions

Money launderers have become so sophisticated in their techniques that it can be incredibly difficult to spot, but there are a number of red flags to look out for, and for property developers, the main one will be sources of cash. In order to complete the placement and layering stages of money laundering, criminals tend to either break up large sums of dirty cash into smaller amounts. This is done in an effort to hide their original source or use shell companies to move larger sums in an attempt to disguise their own identity.

So when a client attempts to move a very large sum, or lots of smaller ones – especially if they are using ‘business’ rather than personal accounts - this should be investigated as suspicious.

The key way in which property developers can prevent money laundering is to ensure their customer due diligence is absolutely watertight. This means running full AML checks on all clients – individuals and corporates – to ensure they are who they say they are. Individual checks will identify, verify and screen the individual, while a business/corporate check will verify the business, and identify the key people associated with that business, and – importantly - its ultimate beneficial owner.

Being able to navigate the opaque and complicated corporate structures financial criminals use to try and hide their activities is absolutely crucial in preventing money laundering, because if an individual has attempted to hide their true identity – and the true source of their funds – through multiple corporate layers and anonymous accounts, you will be able to spot it and stop it.

Hopeful property owners will experience extensive AML checks when buying a house or flat, with these measures being put in place to detect suspicious and illegal financial activity. Failure to comply with AML regulations and responsibilities most commonly results in financial penalties that vary depending on the severity of the offence. While fines are the most common form of punishment, more serious cases can result in prison time.

Staying up to date with AML checks in the property development sector is, therefore, essential, with SmartSearch helping you to easily streamline your operations to make sure you’re constantly compliant.

Anti-money laundering checks when buying a house can be an exhaustive process if you have not first prepared the documentation that you need. You can enjoy a simpler and streamlined process by preparing valid documentation. ID checks require an in-date passport, a valid UK driving licence or a birth certificate. Meanwhile, a proof of address check requires a recent utility bill, a council tax bill, a recent bank statement or a valid UK driving licence.

Ensuring your documentation is up-to-date and valid before a timely submission will make sure that your money laundering checks when buying a house are completed swiftly. Paying for a property using cash will result in a more scrutinising AML process, so prepare a robust proof of funds that will answer any questions before they’re even asked by the relevant parties.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.