Anti-Money Laundering Checks for Financial Firms

Financial Services

Our AML and digital compliance solutions are trusted by over 2,000 financial services firms. Our vision, win customers through trusted identities empowers customers to grow their business with confidence. By providing secure and reliable solutions that meet the ever-changing regulations by the Financial Action Task Force, we enable our clients to focus on their core business activities, knowing that their compliance needs are in safe hands.

The SmartSearch Difference

Driving innovation with trusted solutions for Investment Firms

We are committed to helping our clients achieve their goals through secure and efficient solutions

-

Verify your customer

Identifying and verifying customers and taking all the steps you need to remain compliant takes just seconds with our platform. Use our platform to complete your KYC AML checks within your financial institution.

-

Customer onboarding

Streamline customer onboarding and enhance your client experience with our award-winning platform that negates time-consuming traditional verification methods and minimizes cost and resource for your business.

-

/SmartSearch_OfficeLifestyle_Feb25_004.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_004.jpg)

Do your due diligence

Automate the bulk of your enhanced due diligence using our unique system to automatically discount any false positives, ensuring you remain compliant with minimal effort. A game-changing feature for AML in finance.

-

Monitor your clients

Powered by Dow Jones, our ongoing monitoring feature reviews PEP and Sanction watchlists globally, alerting you to any status changes and keeping you compliant at all times.

-

Prevent fraud

We offer a wide range of anti-fraud products and services that can be tailored to your firm's specific requirements.

-

Be audit ready

Get prepared for audits by using our batch upload feature, ongoing monitoring and automated audit notes, you can be confident that your processes are watertight, and your business will always be audit-ready.

Integrate SmartSearch’s capabilities into your own system

We simplify the KYC process for AML in finance, verifying your clients in both the UK and overseas, so you can get on with what you do best. Get a personalised quote for your financial institution today, and find out how much you could save.

SmartSearch is able to integrate our services with your existing software, so you can run AML checks using information from your own system.

.png?width=400&height=70&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?width=400&height=70&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

Benefits of using SmartSearch

Check an entire company structure within a few clicks

Comprehensive AML business checks can be performed, drawing upon the best international data.

Comprehensive AML business checks can be performed, drawing upon the best international data.

Access global data within minutes

Make the most of the information available through our global data partners, to help ensure nothing has been left untouched in your efforts to minimise money-laundering fraud risk.

Make the most of the information available through our global data partners, to help ensure nothing has been left untouched in your efforts ...

Remove the costs and time associated with manual compliance checks

Benefit from quicker and more cost-effective methods for carrying out AML and compliance checks. Our automated platform can undertake full checks in seconds.

Benefit from quicker and more cost-effective methods for carrying out AML and compliance checks. Our automated platform can undertake full ...

Powerful facial recognition technology ensures accurate document identification

The verification of crucial documents is made easier by SmartSearch’s use of the latest OCR and biometric facial recognition techniques.

The verification of crucial documents is made easier by SmartSearch’s use of the latest OCR and biometric facial recognition techniques.

Our AML and compliance solution is trusted by over 2,000 financial firms

.png?width=204&height=65&name=coop%20(2).png)

.png?width=204&height=65&name=Greystone%20(2).png)

In a constantly changing anti-money laundering compliance landscape it is fantastic to have SmartSearch’s expertise on hand.

Linda Barlow

Co-operative Governance Advisor

Using the Smart Search system has helped to keep admin timings down due to the simplicity and given it is an intuitive system. The new updates have definitely helped to make things even easier.

The IJ Team

Our need for SmartSearch has expanded, originally starting with UK Individual searches and then moving onto UK Business searches. This has assisted us in developing our processes for the better, streamlining and speeding up our onboarding journey.

Stephen Kitchen

Compliance Associate

We offer cutting-edge technology that instils trust and build confidence for finance firms

There are a number of steps that a UK financial services provider should take to ensure compliance with the Money Laundering Regulations. These include, but are not necessarily limited to:

- Ensuring the firm has written policies, controls, and procedures to mitigate the AML fraud risk.

- Making sure those policies, controls, and procedures cover risk management practices, internal controls, customer due diligence, reliance and record keeping, and the monitoring and management of compliance.

- Communicating the policies, controls, and procedures to staff.

- Providing up-to-date staff training on the organisation’s policies and procedures, and how to report suspicious activity.

Additional measures to ensure compliance for your finance firm

- Ensuring the firm is registered with the Information Commissioner’s Office under the Data Protection legislation

- Carrying out a risk assessment on itself in relation to money laundering or terrorist financing risks

- Putting procedures in place to check a client’s identity and business activities, in order to mitigate the risk of money laundering activity

- Carrying out enhanced due diligence on higher-risk customers

- Ensuring the firm has reviewed and updated its AML policies, procedures, and controls in the last 12 months

- Keeping AML records for at least five years after a business relationship with a client ends

How our resources can support you

-

Resource library

Explore our resource library for expert guides and tools to support your compliance processes.

-

Blogs

Discover our latest blog posts for expert tips, features, industry trends and more.

-

Frequently Asked Questions

The 5th EU Anti-money Laundering Directive (5MLD) came into force on January 10th 2020 and although most of the content in this directive was built on recommendations already made in 4MLD, there were several important changes that have proved to be especially impactful. To discover what those are, click here.

The EU Anti-Money Laundering Directive (6MLD) came into effect on the 3rd of December 2020 and had to be implemented by every institution in the regulated sector by the 3rd of June 2021. Discover more about this directive.

The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 (POCA 2002), the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLR 2017), the Terrorism Act 2000 (TA 2000), the Crime and Security Act 2001 (ATCSA 2001) and the Terrorism Act 2006 (TA 2006).

SmartSearch’s award-winning digital compliance solution can perform a KYC check in just 2 seconds and KYB checks in as little as 2 minutes.

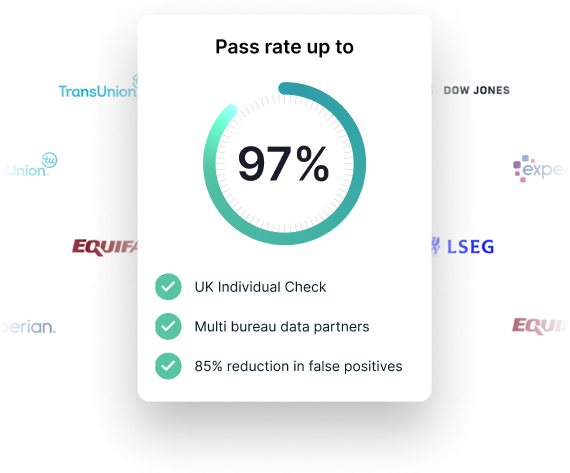

SmartSearch uses Equifax, Experian, TransUnion, Dow Jones, Companies House and LSEG which gives us the broadest and deepest coverage and the most frequent update policy to deliver an industry-leading match rate of up to 97%.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.